Is It Good For The Art Market?

Any period of volatility can prove a frightening time for investors. Meanwhile, the fine art market is traditionally seen as a lower-risk area for investors to place and potentially accumulate their wealth.

A decade ago, during the last financial crisis, the art market responded to the stock market with a lag of about seven months. Bear Stearns collapsed in March 2008, but the May auctions in New York that year set records. Sotheby's held its largest sale ever; over the course of two weeks, $1.56 billion worth of art changed hands.

The question now is: Should collectors, dealers, auction houses, curators, and everyone else who relies on the art market's continued success, be worried?

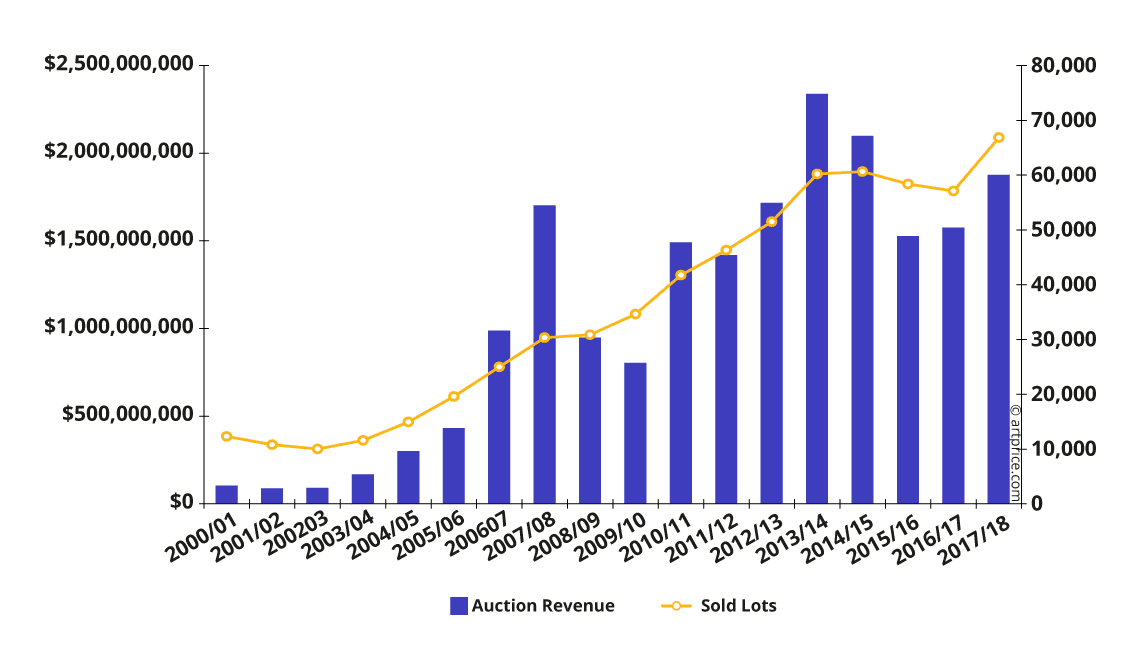

Firstly, the Contemporary Art Market's main health indicators are all positive:

- Global auction turnover has risen +19%, reaching over $1.9 billion

- The volume of transactions have increased +17% with 66,850 Contemporary lots sold

- The price index of Contemporary art increased by +18.5%

The almost identical increase in the Market's three main indicators - all three very close to +18% - suggests a rapid, but perfectly balanced, growth of Contemporary art auction sales. Thus, in the past year we have witnessed an almost uniform progression of the market in terms of prices, lots sold and auction turnover.

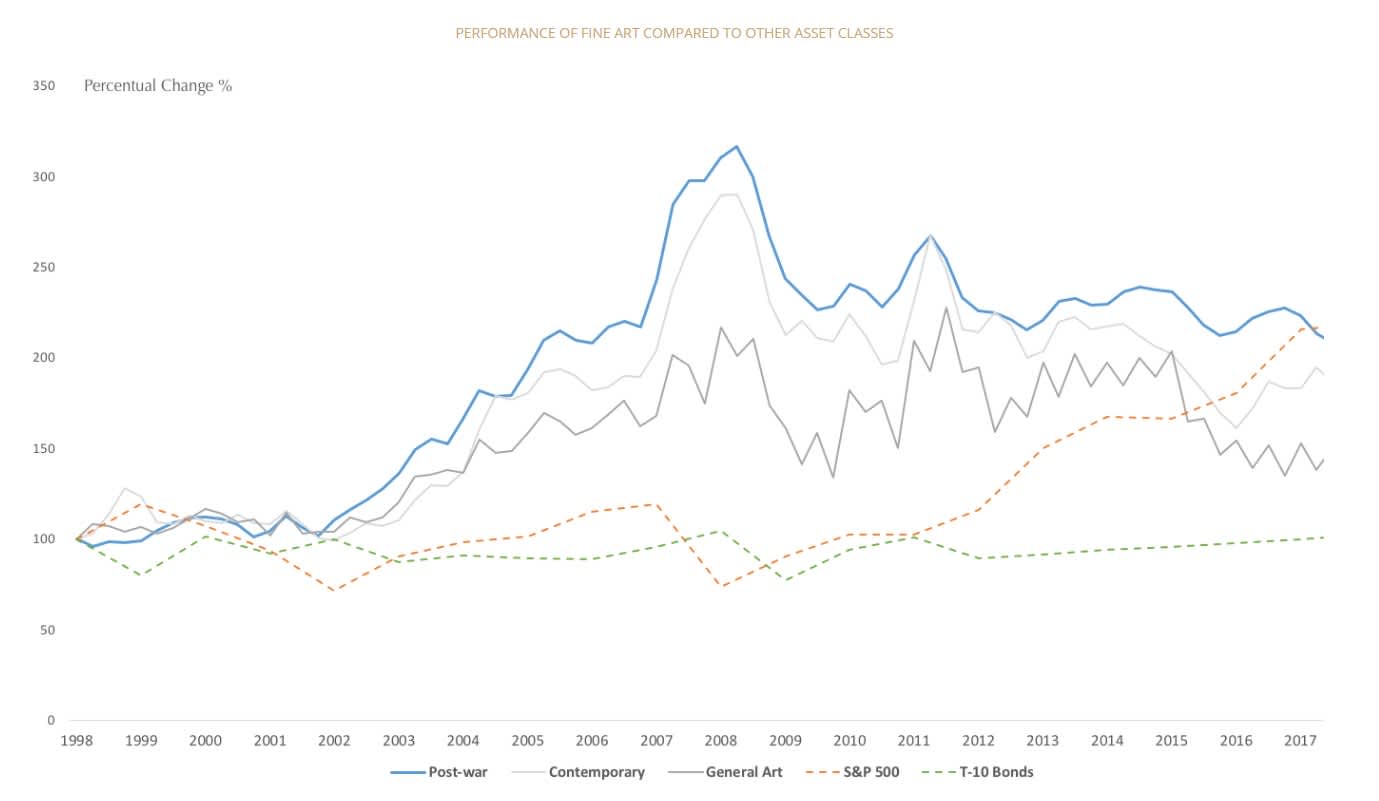

The art market is also one of the most popular areas where people looking for diversified investment opportunities are placing their funds. Fine art has consistently outperformend other asset classes over the years and continues to show its strength, especially against traditional investment avenues such as oil and coal which have seen periods of uncertainty over the last five years.

It's no surprise, then, that art is attracting more interest than ever in the world of alternative investments, with investors drawn to the potential for low risk and high returns compared to traditional assets.

In 2017, high net-worth investors spent more on art as a diversified investment opportunity than wine for the first time in eight years. (according to The Wealth Report, which tracks the spending habits of ultra-high-net-worth individuals)

"In my experience, when the market goes up and down, up and down, that's good for art," says Christophe Van de Weghe, a New York Art dealer. "Over the last 30 years, volatility has been very good for us dealers, because that's when people want to buy a hard asset." Art, like gold, ostensibly represents a financial safe haven during turbulent times.

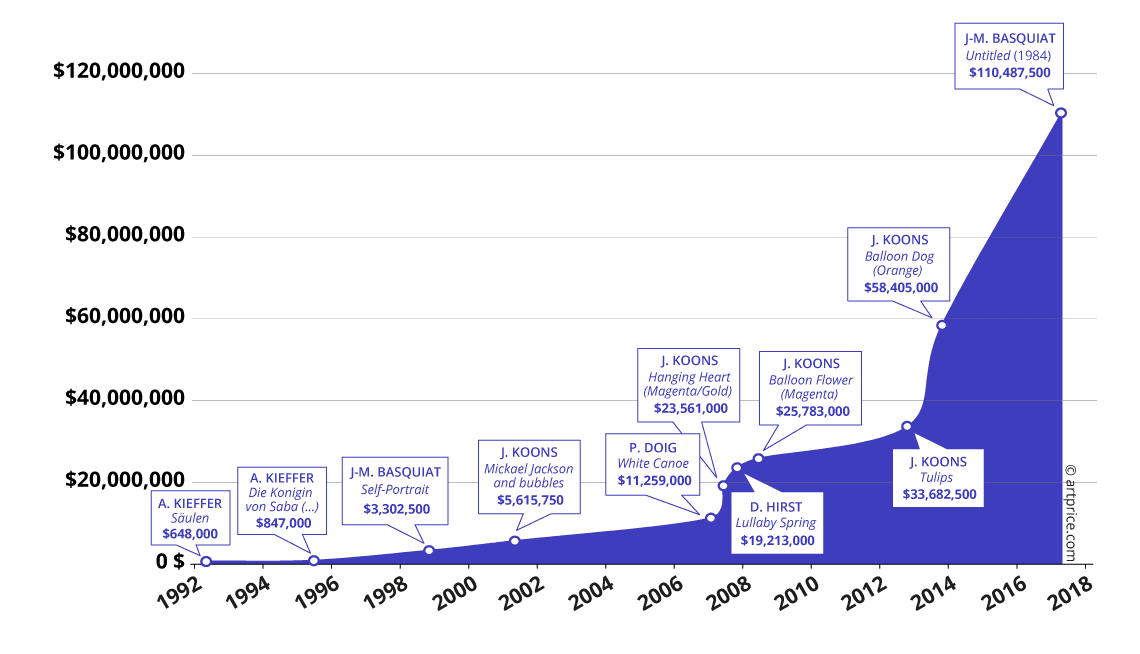

And for the last 30 years, the prices for Contemporary Artworks continue to set records.

Indeed, Van de Weghe says stock market turbulence is a double-plus: One group of collectors leaves the market in order to realize gains, has cash sitting around, and then puts it back into art.

In conclusion, Contemporary Art not only performs as well as other equities but also provides a strong opportunity for an alternative investment to diversify a portfolio.