WHY INVEST IN ART

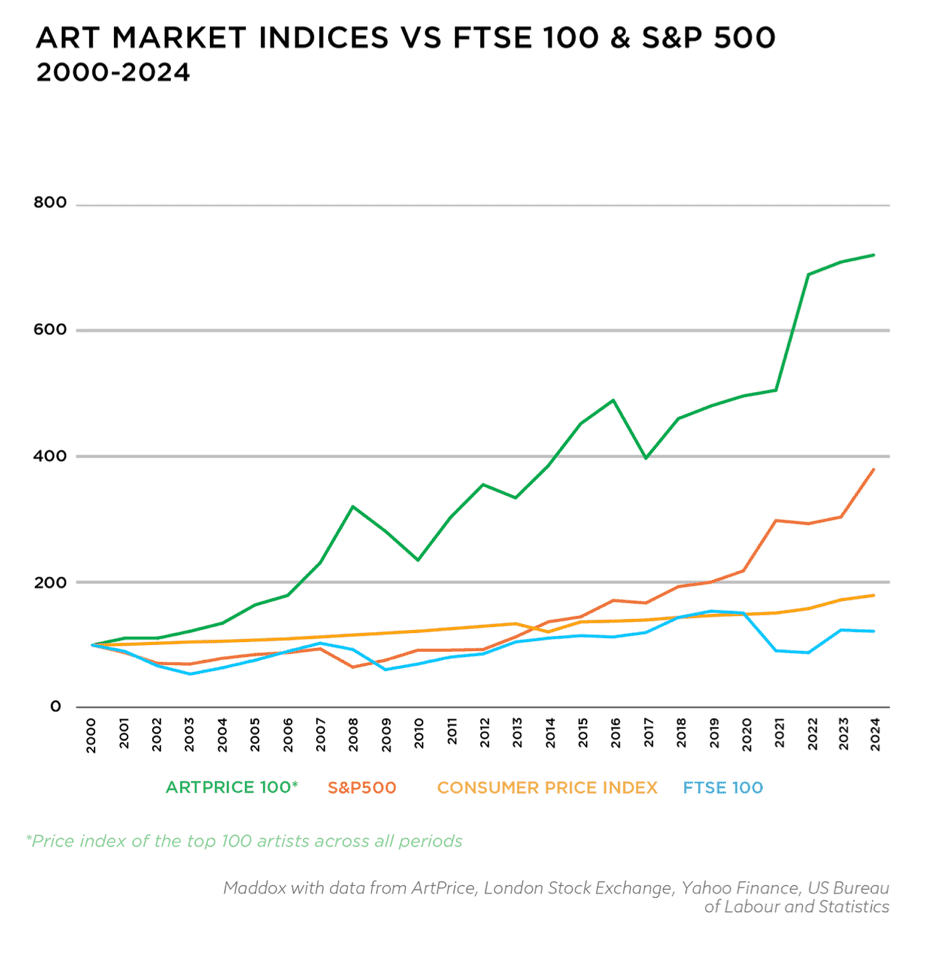

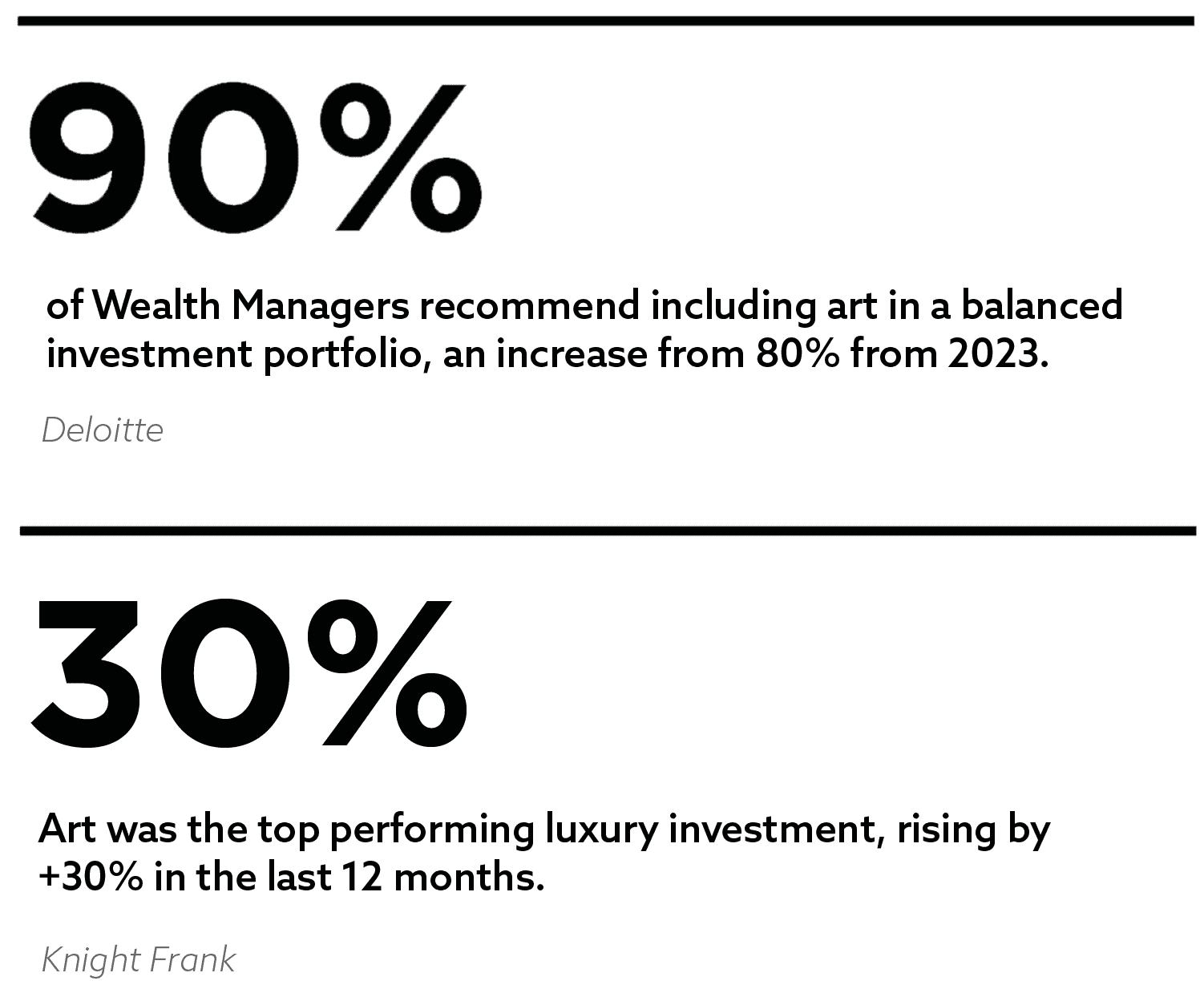

Art is transformative. Not only does it change the way we think and feel, it can also bring big financial rewards. With a $1.7 trillion global marketplace, art can be a highly profitable investment that consistently outperforms other asset classes.

Art has several intrinsic advantages, including low maintenance costs, portability, low volatility, hedging possibilities and the ability to increase in value. Furthermore, the unique interplay between art’s cultural and financial value results in high investment returns that remain stable and can even be fuelled by broader financial turmoil.

Please note that with art investment, past performance is not indicative of future returns. Your capital may be at risk.

Why Invest with Maddox

Successful Historical Returns

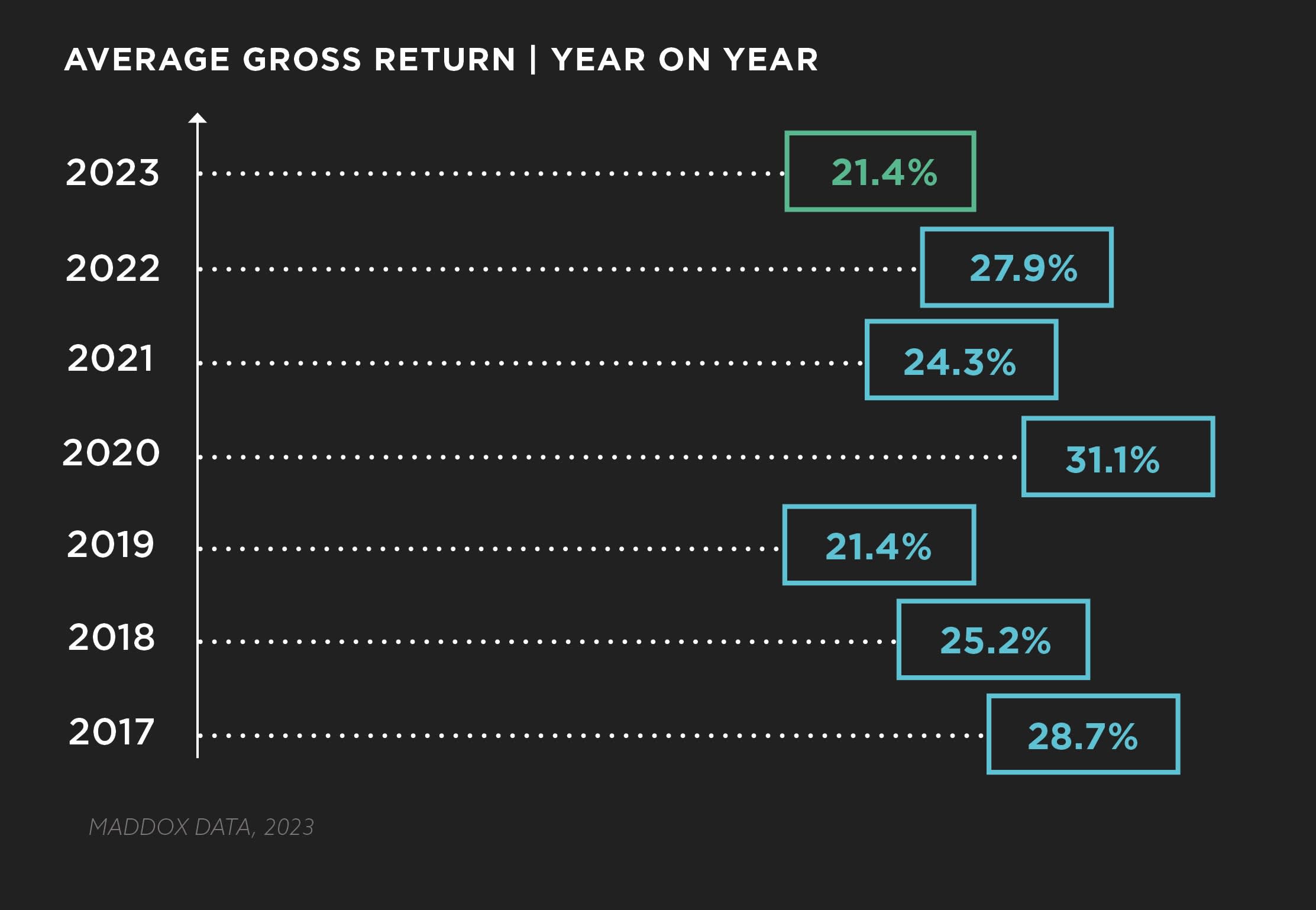

We are proud of our impressive track record at Maddox Advisory. Over the last decade, we have delivered an average return of 25.8% and distributed over £13 million in profit to our clients.

Privileged Access

With expert knowledge and deep industry connections, our Maddox Advisory acquisitions team has established unrivalled access to the contemporary art world and are passionately dedicated to sourcing the highest-quality investment art for our clients.

An Investment to Appreciate

We encourage you to experience the joy of collecting by taking delivery of your artwork and appreciating your investment as it hangs in your home or in your office. We will arrange delivery free of charge or provide storage at a secure location if required.

Expert Portfolio Management

When it is time to sell, there are several efficient and effective routes to market provided by Maddox Advisory’s dedicated sales team—from our network of five international galleries to art exhibitions around the world and a variety of trusted selling platforms.

Our team of experts

Our team of Art Investment Advisors combines their experience in portfolio management, insight into art investment, and detailed knowledge of the contemporary art world to deliver high-quality advice and consistent returns for our clients.

Mario Zonias

Fi Lovett

Rishi Taylor

Matthew Lord

The Process

Consultation

Once you have submitted your details, your dedicated Maddox Art Advisor will provide an art investment consultation free of charge to establish your budget, outline your preferences, including your risk appetite, and answer any questions you may have.

Portfolio Management

Your Advisor will prepare a bespoke investment proposal consisting of works that are most likely to achieve your investment goals.

Delivery or Storage

When you have started building your art portfolio, you can choose whether to have the artwork hung at home or in your office. Alternatively, we can arrange storage with one of our specialist suppliers. We will make the relevant arrangements based on your preferences.

Return on Investment

Your advisor will get in touch when it is a good time to sell your artwork based on current market trends, demand for individual artists and recent sales. Once you have agreed to sell, Maddox Art Advisory will market the artwork at the agreed price.

WATCH THE GUIDE TO INVESTING IN ART

Frequently Asked Questions

The value of investments can go down as well as up. Past performance is not a guarantee of future performance. Liquidity is not guaranteed. Fees, terms, and conditions apply. Please seek your own financial advice before purchasing.

Maddox Advisory is not regulated by the Financial Conduct Authority and is not authorised to offer advice on investments, whether regulated or unregulated. The information provided in this document should not be relied upon as the sole basis for making investment decisions. Maddox Advisory, including its affiliates, officers, directors, and employees, does not guarantee, warrant, or represent the accuracy, completeness, or suitability of the information contained herein and accepts no liability for any errors, omissions, or inaccuracies.

0203 150 0249

0203 150 0249

Download your guide

Download your guide