“Art as an investment will offer welcome inflation protection in 2023” - Jay Rutland, Creative Director

Despite the major macro shifts in the global economy that took place in 2022, analysts such as UBS and Private Bank still expect collectors to compete for investment-grade artworks. This is particularly true of art, which remains an attractive hedge against inflation and an essential component of a broader portfolio diversification strategy.

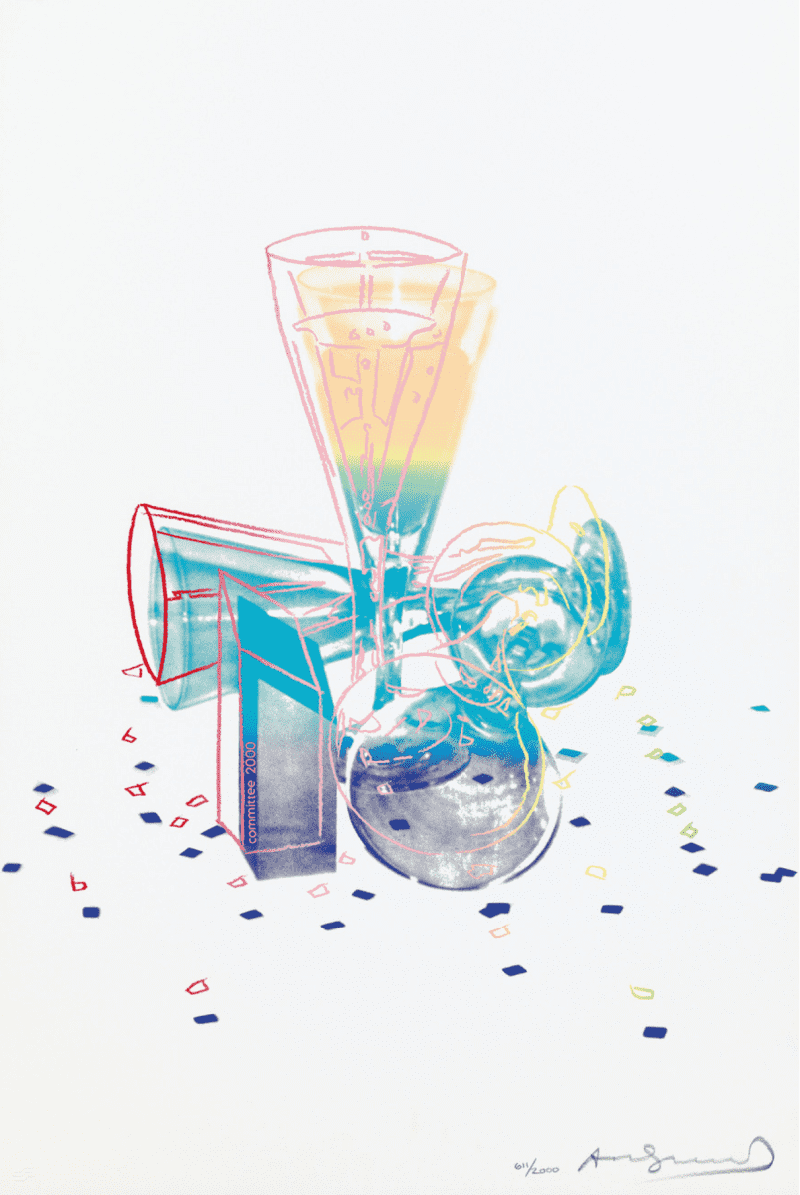

ANDY WARHOL, ORANGUTAN FROM ENDANGERED SPECIES, 1983

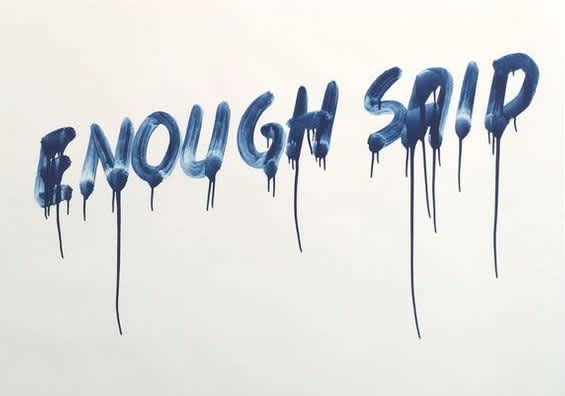

“This year, text-based art will become more prominent” - Maeve Doyle, Artistic Director

Narrative-driven work as a platform for social critique is attracting much attention, thanks to artists such as Barbara Kruger, Mel Bochner and Tracey Emin. This year, Kruger's travelling retrospective will be visiting the Art Institute of Chicago, LACMA, MoMA and the Tate, reinforcing the resonance of her artworks and large-scale installations among collectors in 2023.

MEL BOCHNER, ENOUGH SAID, 2014

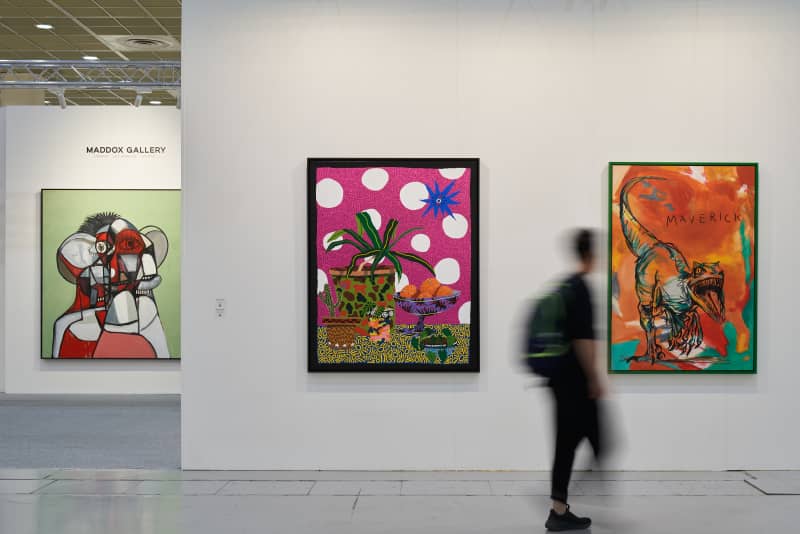

“Seoul will keep growing in its bid to become the next Asian art market hub” - John Russo, Chief Executive Officer

Hong Kong’s political instability, economic downturn and strict Covid controls restricted its art market share in 2022. Meanwhile, record-breaking attendance and sales at this year’s Korea International Art Fair (KIAF) have boosted some industry players’ confidence in Seoul, setting high hopes for the South Korean capital to become the next art hub in Asia. At the same time, Tokyo’s art ecosystem has risen since the pandemic, with Japan making an ambitious and concerted effort to reclaim its previously held status as a dominant force in the art world.

MADDOX GALLERY AT KIAF SEOUL 2022

“The middle market will rise and the top-end market is likely to shrink” - Jay Rutland

Growth at the top-end market segment (+£1M) in 2022 was powered by single-owner auctions, including the Ammann, Anne Bass and Macklowe collections, alongside the unprecedented $1.6 billion treasure trove of artworks in Paul Allen’s masterpiece-filled collection. With the auction calendar finally catching up after the pandemic hiatus, we can expect a contraction on this unprecedented bonanza of trophy lots, opening the way to lower-priced pieces.

HARLAND MILLER, LOVE SAVES THE DAY, 2021

“The demand for female artists will continue to grow” - Maeve Doyle

Works by female artists are proving to be a promising investment, with auction sales for Post-War and Contemporary women artists rising steadily year-on-year. With secondary market prices for female artists growing 29% faster than their male counterparts, according to a BBC documentary, 2023 is predicted to be a record year for this group of female artists.

YAYOI KUSAMA, PUMPKIN (WHITE), 1992

“Rishi Sunak may hold the key to unlocking the UK’s art market” - John Russo

With little room for manoeuvre for the UK economy as we head into 2023, major legislation could prove politically risky for Sunak until things have settled. However, as the owner of an art collection and even making an appearance at Frieze London 2022, the Prime Minister seems to be a more friendly option for the art market,. Anthony Browne, chairman of the British Art Market Federation (BAMF), has met Sunak before: "The good thing is that he very clearly understands the art market and appreciates its importance."

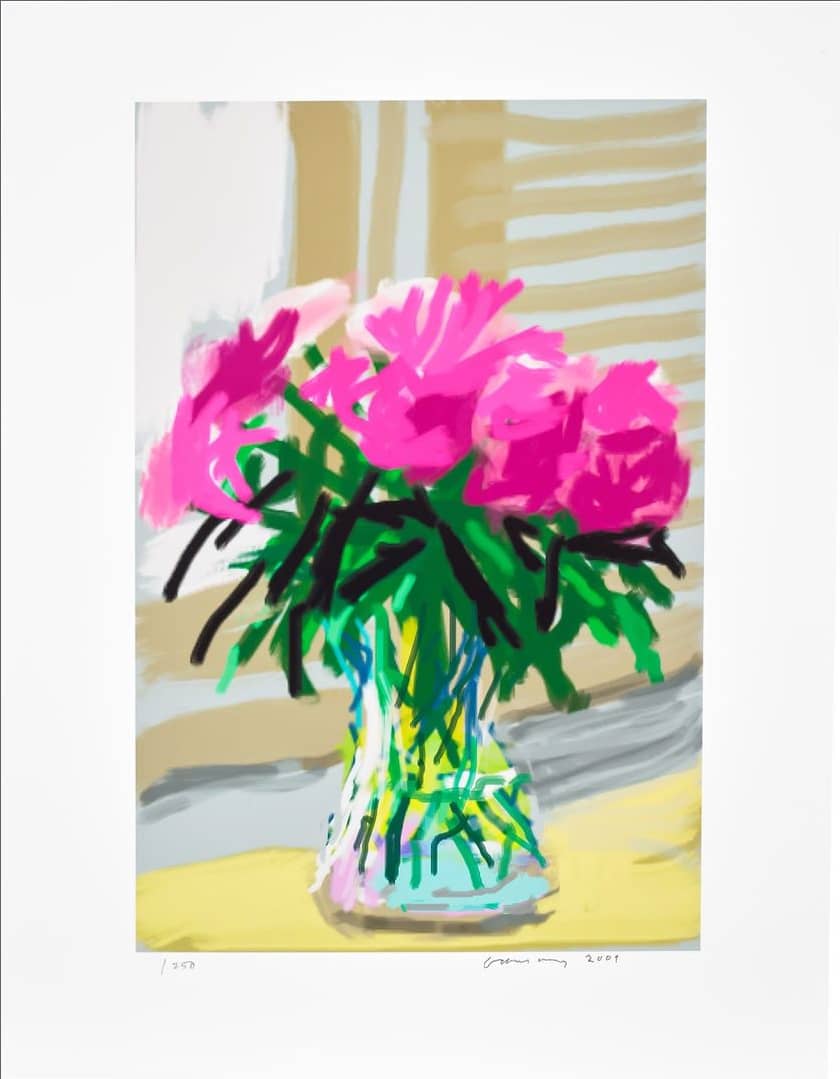

DAVID HOCKNEY, 'UNTITLED' PEONIES IPHONE DRAWING. MY WINDOW NO. 535'

“2023 is going to be the year of Picasso” - James Nicholls, Chairman

This year, the art world will honour the 50th anniversary of Pablo Picasso's death with more than 40 shows and events in Europe and the US devoted to this incomparable artist and his enduring legacy. With the renewed focus on his life and work throughout 2023, his market will inevitably gain traction, with auction records expected to be set in the year ahead.

The 2023 outlook at Maddox

Following the stock market volatility and interest rate hikes of 2022, Maddox Advisory remains cautiously optimistic about sales in the art market in the coming months. The busy auction calendar, exciting curatorial projects and long waiting lists on the primary market are a welcome sign of strong art market confidence in 2023.

Begin your Investment Journey

Download our guide to discover the need-to-know terminology for investing in art, access exclusive industry insights, and discover the benefits of investing in Art with Maddox.