There is no magic formula when it comes to buying art for investment. Here, our Creative Director, Jay Rutland, shares his eight essential tips on how to learn to buy art that will appreciate in value over time.

1. Research an artist’s marketplace and endorsement

To accurately assess an artist’s potential in the marketplace, it’s important to bear in mind a range of factors, starting with their auction history. Look at their short- and long-term performance, average sale price, whether their works sold for above or below their estimates, the number of lots offered and sold, and the geographic distribution of bids.

Focusing entirely on an artist’s auction market can be deceptive, though, especially as only a few Contemporary artists excel in this arena, which is highly dependent on the marketing efforts of an auction house. The true value of an artist’s marketplace is a complex mix of global events, endorsement and scarcity. When a constellation of desirable qualities align – think positive press coverage, curator and influencer endorsement, academic acknowledgement, inclusion in public or private collections, corporate support, social media growth, branding collaborations, art fair appearances and an auction catalogue presence – it creates something known as the Halo Effect (read more about this here), which elevates an artist’s status and increases the value of their art.

2. Approach art investment with a long-term perspective

When you buy art for investment, it pays to take a long-term view, with an extended holding period – the amount of time you hold an artwork for – historically proven to be the most beneficial investing strategy. Freshness is one of the most important components when appraising an artwork, with buyers more likely to pay greater prices for a piece if it hasn’t been offered for sale for a considerable time.

Sotheby’s Mei Moses research has traditionally backed this premise, suggesting that works of art stored for at least 10 years are more likely to be sold for a profit, benefiting from “the holding period effect”. However, Maddox’s performance exceeds the industry standard, with Maddox clients who kept their artworks for 2-3 years received an average return of 46%, while clients who waited more than 5 years enjoyed even higher returns.

3. Spot bargain-buying opportunities

In traditional markets, when investor sentiment sours, it causes market panic and drives prices downward. This creates an opportunity to purchase assets at a lower cost and eventually sell them at a profit when the market rebounds and prices begin to climb again. A great example of this is Banksy, whose work experienced a remarkable surge in value in 2021. His prices have since moderated, presenting enticing opportunities to strategically acquire a piece by the renowned street artist before another anticipated rise in prices.

4. Look out for trends and shifts in taste

Between the years 2020 to 2030, around 20% of the global population is predicted to pass down more than £10 trillion in wealth to their heirs, causing a huge shift in taste in the art world. This wealth transfer is already altering the art investment environment, with iconic artworks from the Old Masters, Impressionist and Modern artists attracting little attention at auction. Conversely, the number of young artists under the age of 40 selling their works at auction has increased fivefold. Due to the incredible prices achieved by some of them, in 2022 Ultra-Contemporary artists made up 2.7% of worldwide Fine Art auction sales, up from 0.5% in 2002, according to Artprice.

It is also worth remembering that tastes in art can change at a fast pace. A recently published Artsy Collector Report revealed that collectors are currently drawn to painting-related genres, with abstract art ranking highest at 50%, followed by expressive figurative works (34%), realist figurative pieces (22%) and contemporary surrealism (17%).

Keith Haring, Untitled, Lithograph (1987)

5. Consider Contemporary art for its potential growth

Depending on your risk tolerance, incorporating art by young Contemporary talent into your portfolio can be a very shrewd move. Early-career artists are particularly appealing to bold investors with a higher appetite for risk due to their potential for quick appreciation, accessibility and affordability. Nevertheless, it’s important to recognise the challenges of projecting the long-term value growth of works by emerging artists, with this type of investment strategy typically reserved for seasoned investors.

6. Beat the market by timing your acquisition

The year 2023 continues to be characterised by economic unpredictability as high interest rates and persistent recession worries remain prominent concerns for the global economy. However, periods of retrenchment or correction can also be great opportunities to build collections. Just look at the late Eli Broad, who amassed the bulk of his collection in the 1990s during the biggest art-market correction in recent history, and Glenstone founder Mitchell Rales, who did the same during the 2008 financial crisis.

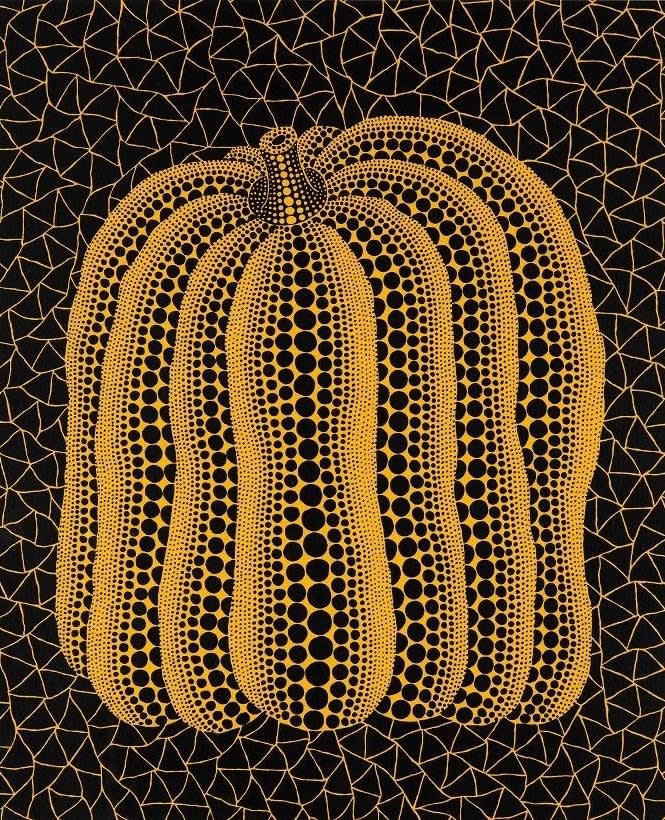

7. Search for talent outside of the traditional hubs

Astute investors with a keen eye for talent outside of the conventional art hubs of Paris, the UK and the USA have reaped substantial profits by being at the forefront of this trend. Just look at the Japanese artists Yayoi Kusama, Takashi Murakami and Yoshitomo Nara, who have enjoyed incredible success in recent years, with signature styles that are appreciated and recognised all over the world.

8. Enlist an Art Advisor to help

The tips above provide a glimpse into the process of identifying art investments that have the potential to appreciate in value, however it’s important to remember that art investment is a complex process with significant risk attached for beginners. By enlisting the guidance of a seasoned Art Advisor at Maddox, you will benefit from decades of accumulated knowledge, alongside access to privately owned artworks and the insights of Maddox’s in-house research team, offering valuable short and long-term benefits for your art investment journey.