The art world in 2024 saw transformative shifts in artistic styles, consumer behaviours and technology driven by innovation and changing cultural and economic landscapes. Discover five pivotal moments that shaped this year's art market by clicking the link below.

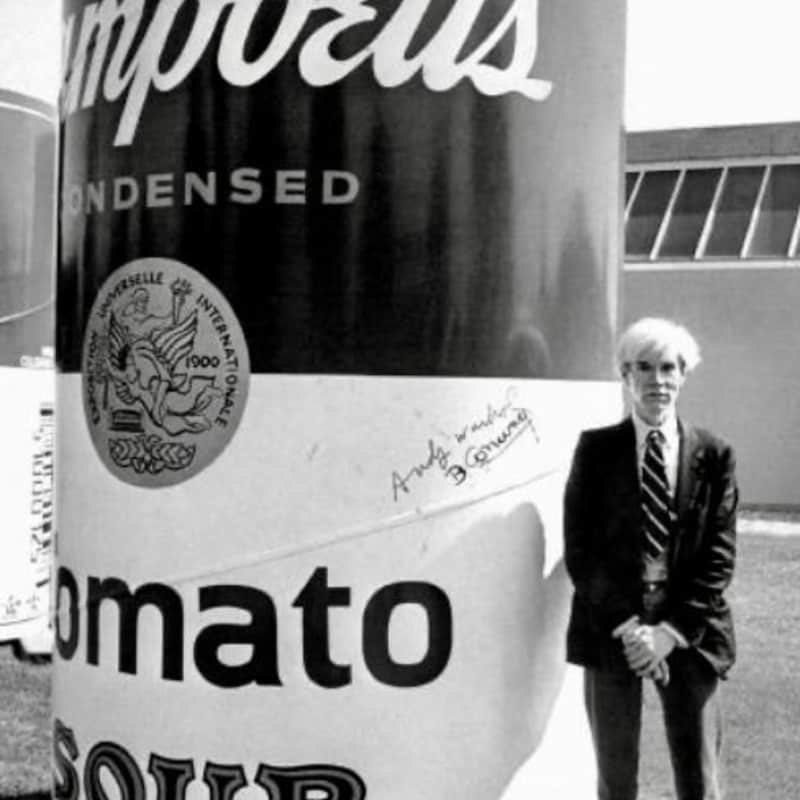

1. Pop Domination

Pop Art reaffirmed its status as a cornerstone of the art market; 2024 was bolstered by strong auction results, major exhibitions, and its enduring appeal across generations. Andy Warhol’s Flowers series achieved notable sales, with Flowers (1964) fetching £28 million at Christie’s New York, while Roy Lichtenstein’s 17 works sold in the New York November sales week amassed $39.1 million, surpassing their high estimate. Institutional efforts, such as Lichtenstein’s centennial exhibition at Vienna's Albertina and the Pop Forever show at Fondation Louis Vuitton, highlighted the genre’s lasting cultural relevance by juxtaposing icons like Yayoi Kusama and Tom Wesselmann with contemporary figures like KAWS and Jeff Koons. These events showcased Pop Art’s ability to bridge tradition and modernity, appealing to both established and younger collectors with its bold aesthetics and ties to consumer culture. As galleries, institutions, and collectors continue to champion its timeless allure, the Pop Art market remains a defining force in contemporary art.

2. Middle East Art Market

In the Middle Eastern art market, 2024 has seen strong growth, with the UAE and the broader Middle East emerging as key cultural hubs, driven by increased personal wealth, investment knowledge, and government support for the arts. A pivotal milestone is Christie’s establishment of a permanent presence in Saudi Arabia, aligning with Vision 2030's goals to diversify the economy and expand cultural sectors. Additionally, Abu Dhabi’s sovereign wealth fund, ADQ, invested $1 billion in Sotheby’s, positioning it as the auction house’s largest minority investor and strengthening its Middle Eastern presence. These developments emphasise a strategic push to integrate the region into the global art market, with Dubai, Abu Dhabi, and Riyadh building cultural infrastructures to attract artists, collectors, and investors, ensuring sustained growth and an elevated cultural profile. In this context, Maddox is proud to announce the upcoming launch of its UAE division, further embedding itself in this dynamic cultural landscape.

3. Faceless Figurative Style

In 2024, facelessness in figurative painting gained momentum as artists like Will Martyr explored identity, universality, and abstraction by omitting faces to focus on the body's expressive potential. Martyr's works juxtapose vivid landscapes with fragmented human figures, using faceless bodies to delve into themes of memory, intimacy, and nostalgia, and inviting viewers to interpret emotional narratives through subtle body language. This shift marks a departure from traditional portraiture that celebrated individuality and status; instead, facelessness democratizes subjects, proposing a universal language that transcends specific identities and encourages a focus on materiality and texture. Artists embracing this approach are redefining how we view the body in art, aligning with contemporary conversations about identity and representation, and exploring themes ranging from personal memory to societal anonymity.

Will Martyr's tondos in his 2024 solo exhibition In Every Moment

4. AI in the Art Ecosystem

Artificial intelligence continued to transform the 2024 art market, enhancing efficiency, engagement, and innovation. Art Basel's AI-powered app, updated for its Miami fair, showcasing personalized features like tailored recommendations and artwork scanning for detailed artist and gallery information, bridging knowledge gaps and unlocking new commercial opportunities. Auction houses such as Christie’s utilised AI to accelerate cataloguing and market analysis, turning labour-intensive tasks into seconds-long processes and offering unprecedented insights into pricing patterns and collector behaviours. AI also advanced artwork authentication, exemplified by Art Recognition’s 96% attribution probability for a Raphael painting. However, challenges persist, including limited access to private transaction data, regional disparities in AI implementation, and ethical concerns over copyright and environmental impact. Despite these hurdles, AI is poised to redefine the art market by streamlining operations, improving transparency, and enabling scalable growth. While it cannot replace human expertise, AI offers a future where technology complements creativity, fostering a more dynamic, accessible, and efficient art ecosystem.

5. Boom below £10,000

The 2024 art market hit an all-time high of 132,000 transactions, driven by digitalisation and auction houses' purposeful expansion of accessible goods. Affordable works under $5,000 dominated the market, accounting for 82% of Contemporary art sales, driven by demand for editions and multiples by prominent artists such as Damien Hirst and Takashi Murakami. The $5,000-$50,000 range also demonstrated resilience, providing collectors with opportunities to secure compelling pieces from both established and rising talents. Meanwhile, the high-end segment faced a 21% decline in transactions over $50,000 amid economic caution, though blue-chip works by artists such as Jean-Michel Basquiat continued to anchor this market tier. An increasing appetite for works on paper, prints, and drawings highlights a shift toward affordable, unique pieces that forge a direct connection to the artist’s creative process.

Conclusion

The developments of 2024 underscore the art world's ability to adapt, innovate, and thrive amidst changing cultural and economic landscapes. With affordability and inclusivity shaping art market trends and technology and unlocking new possibilities, 2024 marks a year of progress and potential. Maddox remains integral to this journey, driving a future where creativity knows no bounds.