Entering the world of art investment for the first time can be daunting, particularly if you have little prior knowledge of the industry. Buying art as an investment is often a complex process and it is only natural to have questions. To assist you in making the most astute decisions, we’ve gathered five of the most frequently asked questions by newcomers to the art investment landscape.

Entering the world of art investment for the first time can be daunting, particularly if you have little prior knowledge of the industry. Buying art as an investment is often a complex process, and it is only natural to have questions.

To assist you in making the most astute decisions while starting your own art investment portfolio, we’ve gathered five of the most frequently asked questions by newcomers to the art investment landscape. Backed up by key data and insight, the answers will give you a better understanding of the art market as a whole so that you are better informed on how to invest in art, the best art to invest in, how long you should hold onto your art investments for, the fees involved in art investment and much more.

How long should I hold my art investment for?

The art marketplace is a dynamic, constantly evolving landscape with real value increasing potential, if you approach it with patience and a long-term mindset. At Maddox Advisory, we recommend holding a piece of fine art for a period of at least three to five years. Although time frames can vary depending on the artwork and artist in question, this is historically proven to be the most beneficial investing strategy.

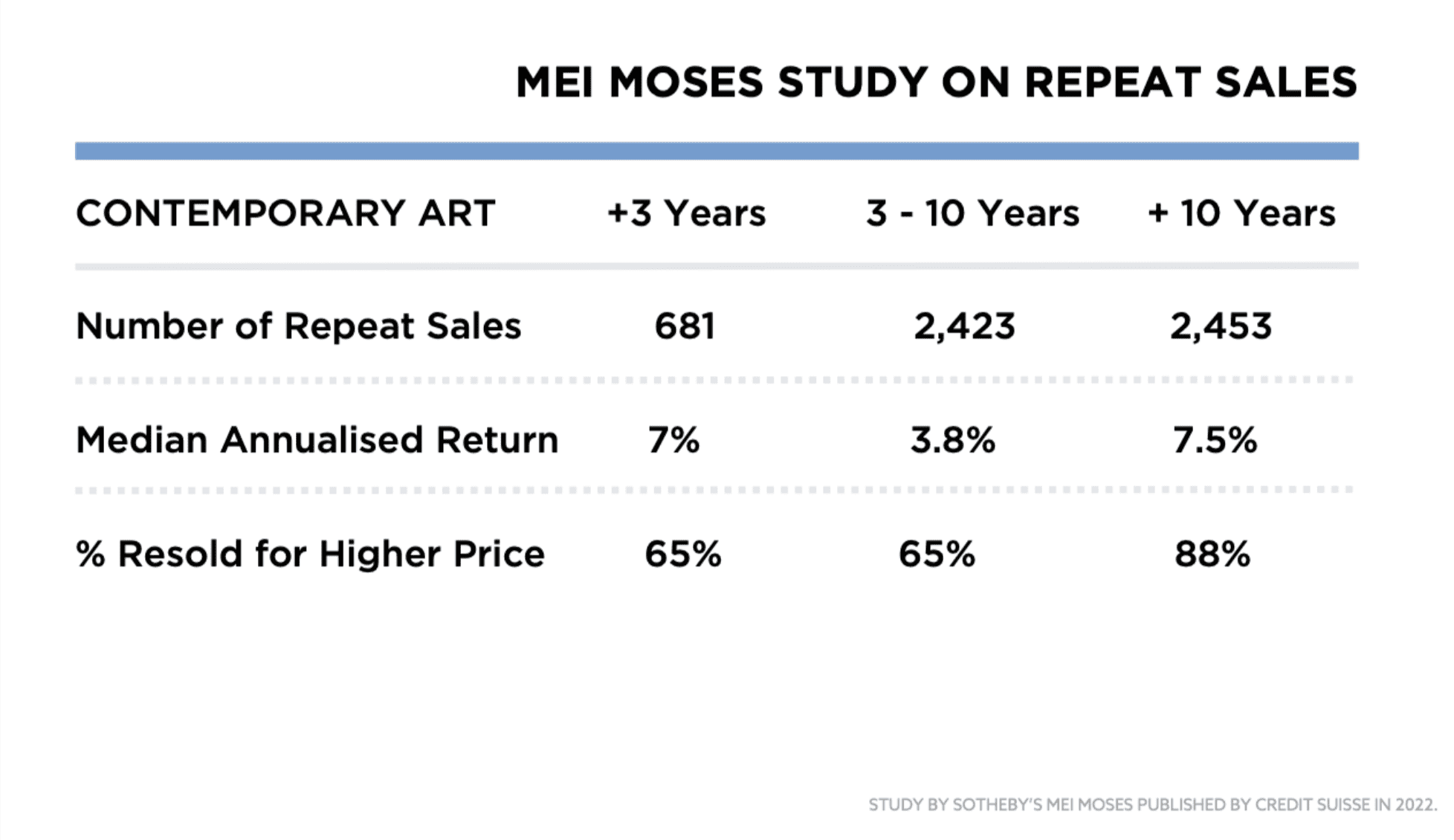

Freshness to the market is one of the most important components when establishing the value of an artwork and, generally speaking, the more time an artwork is held privately, the higher the resale price it will achieve. If an artwork hasn’t been available for sale for a substantial amount of time, buyers are more willing to pay higher amounts to secure the piece. Repeat auction sale data from the Sotheby's Mei Moses Indices, published by Credit Suisse, shows that artworks kept for at least 10 years are the most likely to resell for a profit.

When should I expand my portfolio of investment art?

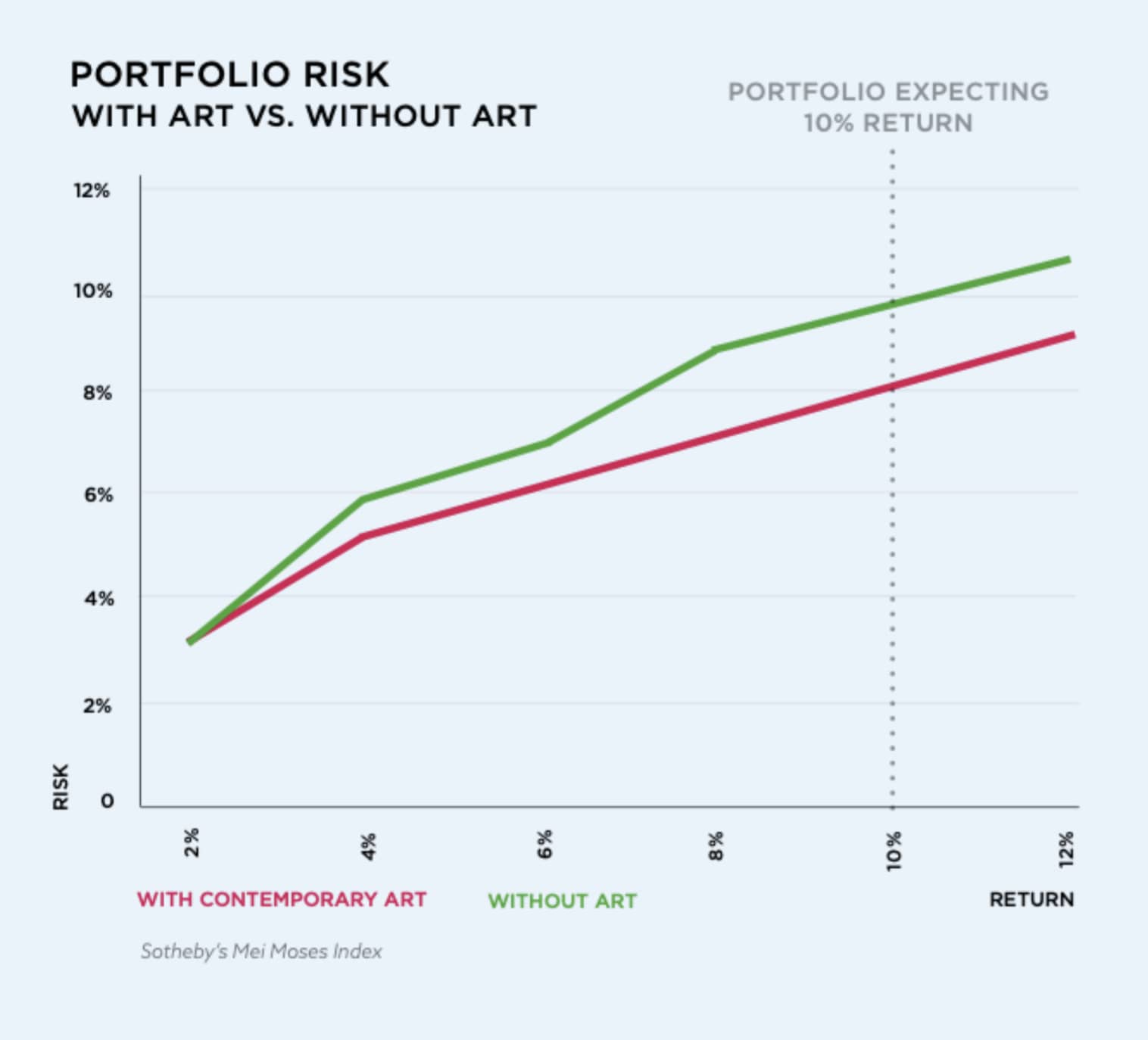

When embarking on any investment, it is advisable to develop a portfolio that combines different asset classes to balance risk and return and maximise the opportunity for success. According to Sotheby’s Mei Moses Index, in a portfolio with an expected return of 10%, the risk is reduced from 10% to 7% if the portfolio includes art. With a low correlation to other major asset classes, such as stock and bonds, including art in your investment portfolio can be a lucrative way to diversify it beyond more conventional means.

The primary factor to consider when expanding your art investment portfolio is balance. There isn’t a one-size-fits-all rule when it comes to the speed of portfolio development. Instead, your focus should be on ensuring your investments are well-rounded and thought out, allowing for stable growth.

Partnering with an art advisory service such as Maddox Art Advisory will provide invaluable help and guidance in this respect. Your dedicated art advisor becomes your compass in the art world, guiding you through its nuances and assisting you in expanding your investment art collection steadily and carefully, advising you on the best time to buy based on current market trends, and the best artists to invest in, according to demand and recent sales.

Is it better to keep my investment art in storage or at home?

Professionals often advocate for clients to buy what resonates with them, allowing them to reap the joys of art appreciation in their living or office spaces. Experiencing an artwork as it appreciates in value is one of the unparalleled perks of art investment.

At Maddox Art Advisory, we encourage taking delivery of your physical artwork to experience the pleasure of ownership. However, if displaying your investment art isn’t feasible or desired, there are dedicated fine art storage facilities, available via third-party specialists, that can hold your artworks for you. One advantage of storing rather than displaying your artwork, especially if you are mulling a future sale, is that stored artworks provide quicker access for potential viewings.

How easy is it to release my art investment funds?

When buying art as an investment, it’s essential to bear in mind that art is relatively illiquid compared to other asset classes, such as stocks or bonds. Not something you can quickly exchange for money, selling an artwork often takes time, and it is important to factor this in when contemplating investing in art. However, what art lacks in liquidity it makes up for with its inherent qualities of timelessness, uniqueness and global appeal, together with its lower price volatility and ability to hedge against inflation, making it a relatively secure asset.

Although it is not possible to instantly sell a work of art at a predetermined price, when the time comes to liquidate your art, Maddox Gallery has several efficient and effective sales avenues designed to maximise the exposure of your art. From an extensive network of international galleries and global art exhibitions to a plethora of trusted selling platforms, once you’re ready to part with a piece, the Maddox team steps in, promoting the artwork and ensuring its visibility across its vast network.

Are there fees involved in buying art as an investment?

This really depends on who you are buying from. We recommend reading up on the financial aspect of art investment to ensure you enter the industry with eyes wide open and avoid incurring any unexpected fees.

With a business model that revolves around the performance of your art, Maddox Art Advisory provides a holistic approach to managing your art investment portfolio, with no hidden costs. The only time Maddox charges is when an artwork that was sourced through them is successfully resold, in the form of a 20% commission on the profit.

Is the art market regulated?

Art is not yet regulated by the Financial Conduct Authority in the UK. However, HMRC has set out strong Anti-Money Laundering (AML) regulations regarding all art transactions, from both a buyer and seller perspective, to help detect and report suspicious activity. Additionally, over 167 laws regulate the British art market alone. Likewise, New York City has developed its own Arts and Cultural Affairs Law, which governs the course of business between artists and dealers.

While regulation may become necessary in the future, in its absence, reputation is the most important signifier of trust in the art market. With its repeated success in making art transactions, since 2017 Maddox has built up a worldwide reputation, distributing over £13 million in profit based on 2,000 individual returns. It has also opened multiple galleries in London and Gstaad, Switzerland, discovered, nurtured and launched a host of new artists and educated thousands of clients in how to invest in art that is most likely to appreciate in value.

To find out more about Maddox’s art investment services, download the latest Maddox Art Investment Guide. It covers all the important questions around how to buy art as an investment - including is art a good investment, how to start investing in art and the best art to buy for investment - offers expert guidance on the workings of the art market and distils the latest market intelligence. In it you will find a comprehensive overview of the salient features of today’s art market and key facts and trends, as well as information on how Maddox can guide you to make the most rewarding investment choices.

The value of investments can go down as well as up, and past performance is not guarantee of future performance. Return figures shown are gross; fees, including a 20% performance commission, may apply. Liquidity is not guaranteed. Terms, limitations, and withdrawal conditions apply. Minimum recommended investment is £20,000. Maddox Advisory is not FCA-regulated and does not give financial advice. Seek independent advice before investing.