As passion investments, both fine art and fine wine offer exclusivity and potential financial growth. But when it comes to stability, long-term appreciation and cultural significance, one stands above the other. In this expert analysis of fine art vs fine wine investment—the third article in our Art vs Alternative Investment series—discover why art remains the superior choice for discerning investors.

Introduction

With a surge of new and established investors seeking alternatives to investing in the stock market, non-traditional assets such as art and fine wine are increasingly becoming core to investor portfolios. Why? Alongside stories of incredible returns, these kinds of alternative investments, often referred to as passion assets, occupy a unique space where personal taste meets financial opportunity.

It’s easy to see why. With the potential to bring great emotional satisfaction and fulfillment while appreciating in value, the enjoyment and satisfaction of art investment and fine wine investment are key motivating factors to owning them.

In the aftermath of the financial crisis, physical, rare and non-fungible assets like art and wine are increasingly seen as reliable investment options. With traditional financial markets volatile and interest rates at historic lows, the appeal of alternative assets offering potentially lucrative returns unlinked to broader market fluctuations is undeniable.

In this article, the third in a series, we will be exploring the art vs fine wine investment debate in more detail, comparing the pros and cons of each to discover why art comes out on top as the superior choice for discerning investors.

Andy Warhol, Grape Series (1979)

1. The Case for Wine Investment

Wine, once seen purely as a luxury indulgence, has matured into a sophisticated investment class that combines cultural heritage with financial resilience. Beyond its intrinsic value, fine wine offers a rare blend of stability, exclusivity, and potential for impressive returns, making it a compelling choice for discerning investors.

Advantages of Fine Wine Investment

Fine wine investment has demonstrated consistency and stability through the years. Looking back at its historical performance, annualised wine investment returns total 13.6% over the past 15 years, as noted by Entrepreneur magazine.

Another advantage of wine collecting for investment is its reputation as a low-volatility asset. An effective hedge against inflation, when traditional markets fall, fine wine tends to hold steady, successfully weathering rising prices and economic downturns to deliver consistent returns.

Like art, fine wine is a tangible asset. A physical commodity with intrinsic value, while stock markets can crash and share prices collapse overnight, tangible investments are stable stores of value that do not cease to exist—unless, of course, they are drunk.

Wines with long-established reputations for reliable quality and aging potential consistently attract collector interest. With a limited supply due to the strict conditions they are produced under and their consumption as they enter their optimum drinking windows, there is high demand for the best performing investment wines.

Investing in Wine Futures—the process of buying unfinished, young wines before they are released onto the market—can also be a rewarding investment strategy. Bear in mind, though, that this requires intimate market knowledge and comes with significant risks.

Disadvantages of Fine Wine Investment

Traditionally a stable asset, fine wine investment has provided modest gains in recent years but relies heavily on vintage quality and provenance, which can restrict growth.

Wine investment evokes a similar degree of passion as art. It can also offer returns through rarity and vintage demand. However, it is a consumable asset that diminishes with use. It goes without saying that those who invest in fine wine cannot drink it and are therefore denied the pleasure of enjoying their assets.

Then, there is the subject of storing your wine investments and insurance to safeguard them. Holding onto wine costs money. Because it is a perishable commodity, long-term, automated atmospheric conditions are required to maintain the quality of your wine investments.

Climate change poses a severe threat to the stability of the wine market, jeopardising its long-term investment potential. In France, declining exports, exacerbated by competition and logistical issues linked to climate shifts, are undermining its position as a global wine leader.

Overproduction is a lesser-known disadvantage that you should also be aware of. France has been forced to set aside $216m to fund the destruction of surplus wine to shore up prices, with the destroyed wine enough to fill 100 Olympic-sized swimming pools. This overproduction has caused a plunge in demand, leading to lower prices and financial struggles for winemakers.

Wine is not immune to market volatility. While fine wine has proven to be a relatively stable investment compared to other financial assets such as stocks and bonds, returns are far from guaranteed. Prices can be influenced by many factors, including changing consumer preferences and economic conditions.

And when the time comes to sell investment wine? It can be tricky because wine is an illiquid asset. Be prepared to wait months to get a good price for your investment.

2. The Case for Art Investment

Art transcends mere decoration, serving as a bridge between cultural expression and financial opportunity. With its ability to preserve value across economic cycles while offering profound aesthetic and emotional rewards, art investment stands out as a uniquely enriching way to grow wealth.

Advantages of Fine Art Investment

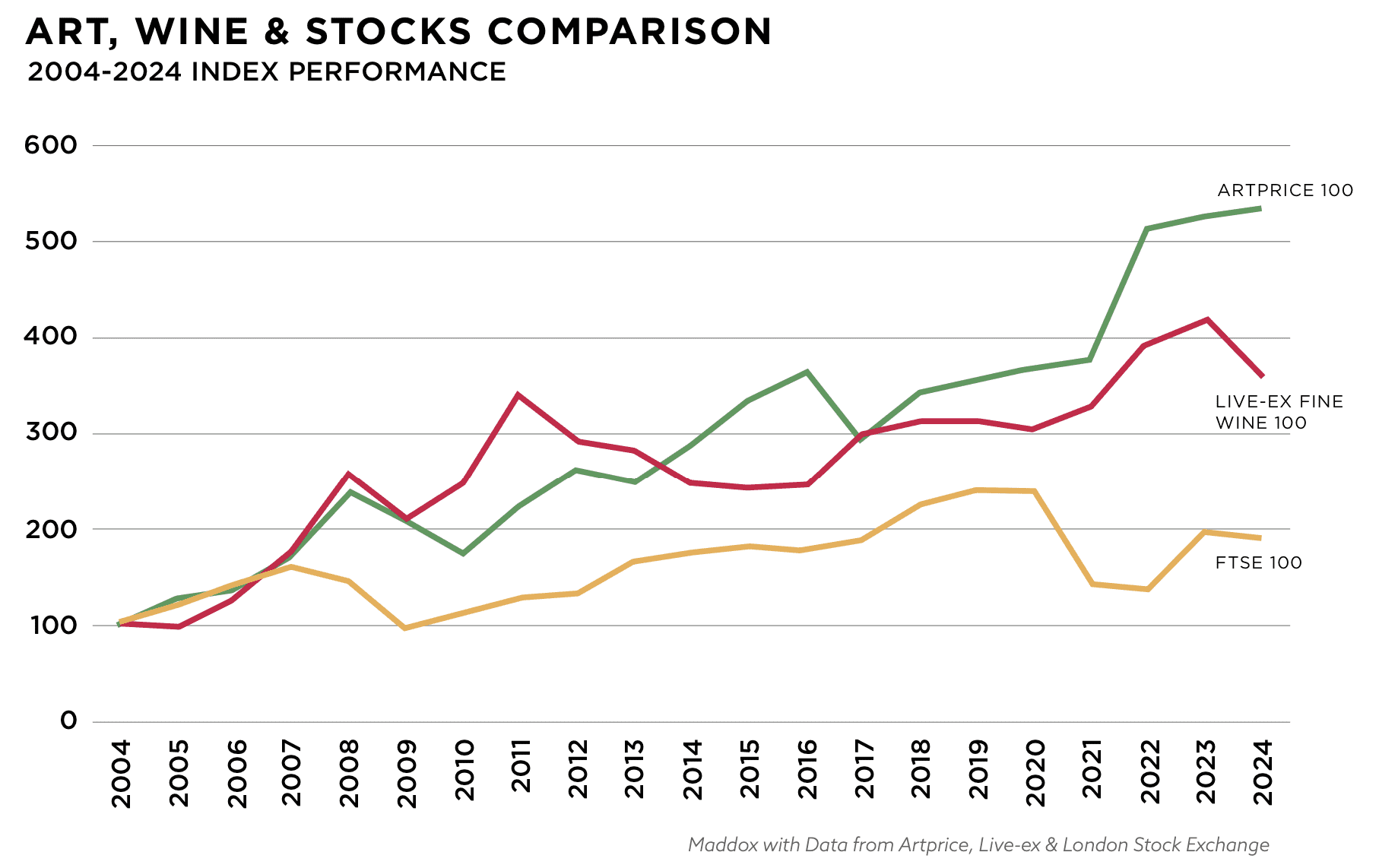

With over half a century of solid returns, the most compelling advantage of art investment is its historical performance. Since 2004, the Artprice100 index has increased by 433%, whereas the Liv-ex Fine Wine 100 index increased by 258% over the same period. In 2024, art returns consistently topped all other asset classes, including wine, whiskey, luxury watches, diamonds, classic cars and gold.

Like gold, art is a perceived safe-haven asset with a negative correlation to the stock market. In times of elevated uncertainty, whether due to war or resurgent inflation, art is a value-presenting real asset with prices based on scarcity and societal value.

Serving as an excellent portfolio diversifier, art investment can offer impressive rates of short and long-term returns while reducing the overall risk of your capital by balancing more volatile asset classes. Among the high yield alternative investments, art consistently holds its value. Providing stability in a diversified investment portfolio, high-quality artworks, especially those by renowned artists, have the potential for significant financial gains.

A final, major plus point for all investors who love to collect art is that art enriches your life like no other asset class. Distinct from traditional assets that are tied closely to economic cycles, investing in art as an asset class brings great aesthetic pleasure and intellectual stimulation.

Disadvantages of Fine Art Investment

One of the biggest concerns for those interested in art investment are provenance and valuation challenges. A documented history of ownership, provenance has a huge impact on an artwork's worth and collectibility. Without it, it can be very difficult to establish authenticity, exacerbated by the prevalence of counterfeits. Valuing art is also a very complex business. Seeking expert advice is therefore essential.

Art’s lack of liquidity is another disadvantage, particularly if you need to part with your assets quickly. Selling art, like fine wine, can take time because it requires finding the right buyer.

The proper care of an art collection involves extra expenses. Improper storage can ruin a valuable bottle of wine and a work of art. Like other passion investment classes, such as luxury watches, classic cars and wine, storage and insurance costs for art must be factored in.

Lastly, if you are not planning on hanging your art investment in your home, storing it in a dedicated fine art storage facility is the best way to help protect its value—but it costs. It is also essential to insure irreplaceable high-costs items such as art in your home or storage facility, with the cost very much dependent on an artwork’s value.

3. Comparative Analysis: Fine Art vs. Fine Wine Investment

The first point in our art and wine investment comparison is positive for both assets: their market performance has been consistently positive. Let’s decant the data. With a long trading history, each has shown consistent appreciation over time. However, since 2019, art has consistently emerged as the top alternative investment, rising in value by an impressive 50%, while wine has appreciated by only 15% over the same period.

Art also offers something very significant that wine lacks: cultural significance. Beyond financial gains, art holds an intrinsic value in society. Serving as a custodian of heritage, collecting art contributes to the passage of art history and can have real cultural and public significance as an artist’s reputation evolves. The value of this to the investor is unmeasurable.

Art and wine are both classified as illiquid assets, which means they cannot be easily and quickly sold for cash. It can take time to sell both wine and art, and you will have to pay a commission on the sale of each.

Whether you buy fine wine for investment, or art, both asset classes come with risks. While each is considered a loss-volatile investment, in comparison to stocks, shares and hedge funds, their value trajectory can still be influenced by market forces such as supply and demand, as well as factors like societal dynamics and economic fluctuations.

Finally, consumption depreciation is simply not an issue with art. Wine investments have a shelf life, art does not. Art can be appreciated and enjoyed for a lifetime and beyond, becoming a significant part of an investor’s legacy.

Conclusion: Why Maddox Gallery Recommends Fine Art Investment

The ownership of passion assets is often linked to an investor’s interests, which is why collecting them is so pleasurable. While they can hold great personal and emotional value, we encourage investors to consider their investment goals and risk tolerance alongside their personal passions when choosing between art, wine or other alternative assets.

If you are still on the fence when weighing up art vs fine wine investment, art is historically proven to be the stronger option for long-term appreciation, market stability and unique resilience in times of economic distress. While fine wine can offer returns through rarity and vintage demand, it is a consumable asset that diminishes with use and is subject to storage risks and market volatility. Art, on the other hand, retains its physical integrity over time and often appreciates in value as it gains historical and cultural significance.

As a widely available asset class, fine art has proven itself to be a superior investment choice for long-term portfolio growth and diversification time and time again. With an intrinsic beauty and historical significance that is unmatched, art makes a compelling argument to be in everyone's portfolio.

Explore other articles in the Alternative Investments series, including:

The Maddox Gallery Advantage

Maddox Gallery was founded to help clients overcome the challenges of fine art investment, such as authentication and identifying the artists with the highest potential for substantial returns. A global market leader in art market analysis, our goal is to assist investors in creating the most profitable and satisfying art investment strategies when navigating the multi-billion-dollar art industry.

Maddox Art Advisory is designed as a space to discover the joy of owning and collecting art, guided by expert advisors. With unrivalled access to the Contemporary art world, our bespoke services are carefully tailored according to your risk tolerance and return objectives, taking into consideration asset protection, capital preservation, diversification and your personal taste.

Experts in portfolio management, we are dedicated to sourcing the highest-quality investment art for our clients, with a certificate of authentication provided with every piece of art for sale. We also oversee the delivery of art to a client’s home or can arrange specialist storage in a temperature-controlled facility, depending on their preference.

To learn more about the benefits of art investment, explore investment art for sale and begin building your art portfolio. Book your private consultation with a Maddox Gallery Art Advisor.

The value of investments can go down as well as up, and past performance is not guarantee of future performance. Return figures shown are gross; fees, including a 20% performance commission, may apply. Liquidity is not guaranteed. Terms, limitations, and withdrawal conditions apply. Minimum recommended investment is £20,000. Maddox Advisory is not FCA-regulated and does not give financial advice. Seek independent advice before investing.