The art market, like pretty much everything else in our culture, has become all about the here and now. Today’s buyers tend to be interested in paintings by artists who are under 45, not over 400. Experts say that younger collectors often regard art from the distant past as remote and irrelevant, and find the technical aspects of a sale off-putting. “Old Masters are difficult to approach because of the problem of condition and attribution.”

The seismic shift in collecting taste from the old to the very new was summed up in the record-breaking interest in emerging talent last year. Sotheby’s, Christie’s and Phillips offered works by a record 670 artists under 45 in 2024, grossing more than $300 million, according to ArtTactic.

So who are these new collectors, and what do they really want?

As Georgina Adam of The Art Newspaper notes, the “NextGens” (defined as millennials and older Gen Zs now in their 30s and 40s) are not just reshaping the art market; they are set to inherit as much as $84 trillion in wealth over the next two decades. But their buying patterns, values, and expectations are dramatically different from those of their parents and grandparents.

Here’s what defines them, and how Maddox is adapting to meet them where they are:

1. Different Tastes, Different Icons

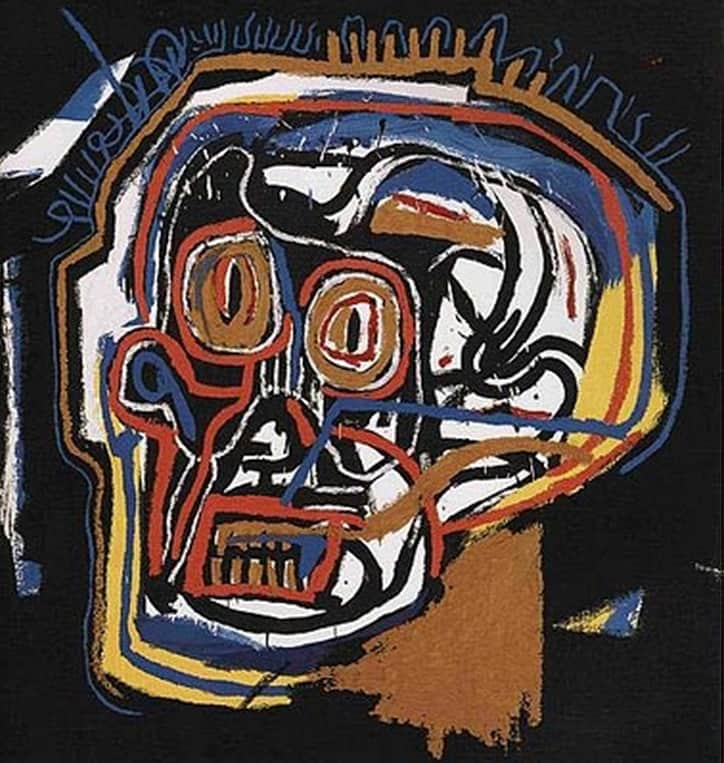

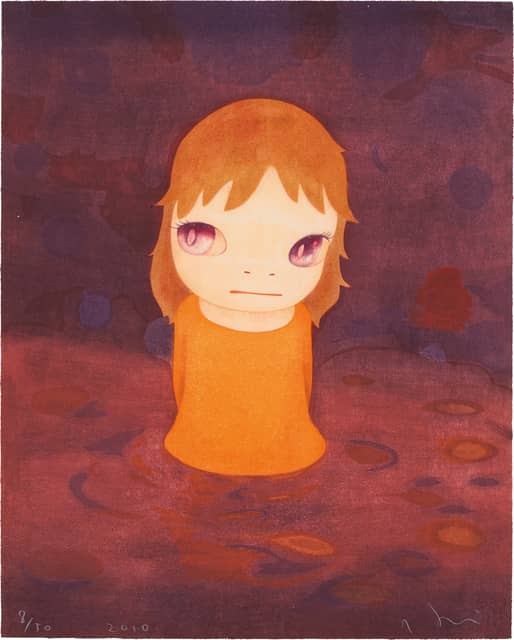

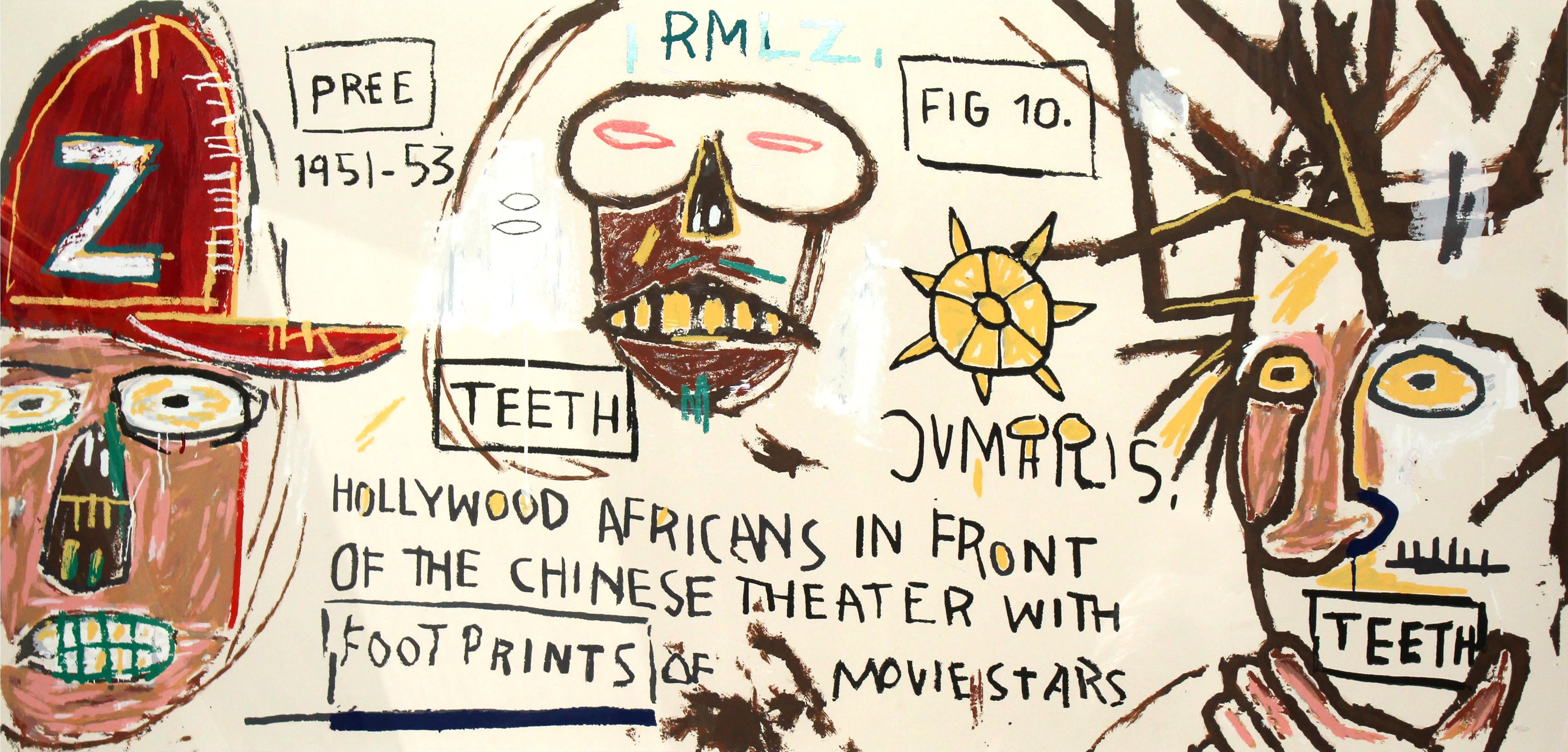

“They don't have the same taste as their parents… NextGens have different tastes, liking women artists, Surrealists, Basquiat, KAWS and even Banksy.” – Georgina Adam

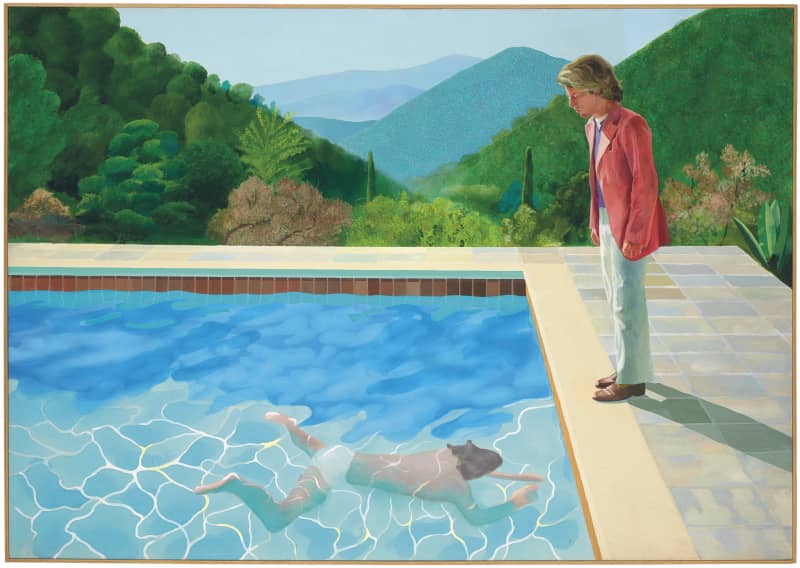

Gone are the days when the prestige of collecting was defined by Old Masters or the canonical postwar giants. Today’s collectors are excited by bold narratives, diverse voices, and provocative ideas. They’re drawn to living artists who reflect their world, artists like Cooper, Mulgil Kim, or Jerkface, whose works tackle identity, activism, and emotion with urgency.

Maddox taps directly into these evolving tastes by spotlighting rising stars and culturally relevant names, with a strong emphasis on gender parity, global representation, and fresh perspectives. Maddox curates not for legacy, but for relevance, aligning its inventory with what speaks to NextGen values and aesthetics.

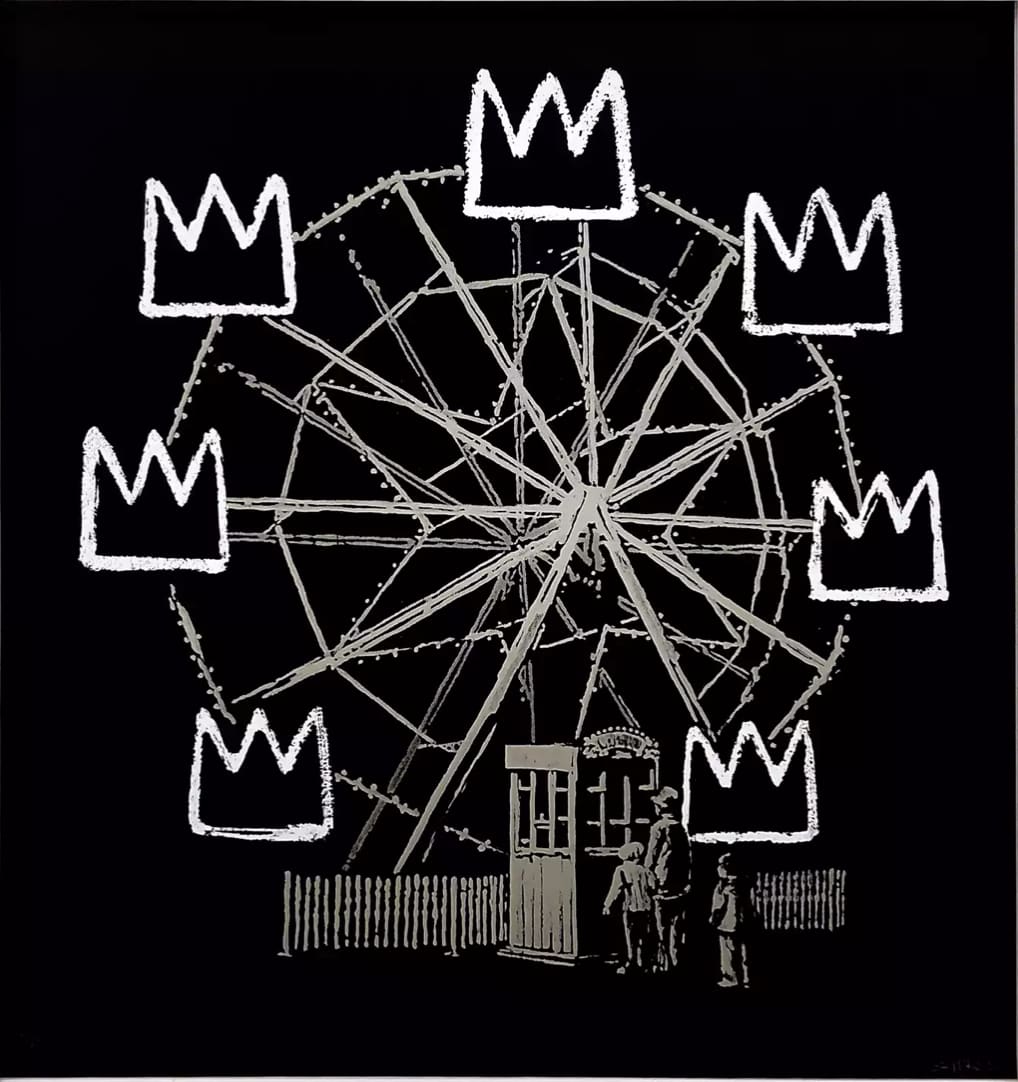

Banksy, Banksquiat (Black) - Signed, 2019, Edition of 300

2. Value-Driven Collecting

“They are motivated by causes their parents probably didn't pay much attention to… Climate change, gender equality, racial tolerance, identity.”

This generation doesn’t just buy with their eyes, they buy with their values. Many see collecting as a form of advocacy, investing in artists who challenge the status quo or explore themes of sustainability, inclusivity, and social justice.

Maddox amplifies this value alignment by intentionally working with artists whose practices intersect with today’s most urgent conversations, from environmental awareness to queer identity. This isn’t about marketing spin; it’s about understanding that art for NextGens is an extension of personal ethics and worldview.

3. Institutional Distrust

“Gen Z and millennials are sceptical of traditional institutions… That impacts cultural institutions as well.”

Younger collectors are not impressed by the usual gatekeepers, the museum boards, the auction house pedigrees, the critic elite. They rely instead on peer networks, influencers, social media, and independent research to validate their choices.

Maddox embraces this decentralization of authority, offering a more democratic, transparent, and digitally accessible art advisory experience. The gallery’s content-rich platforms and online tools foster self-education, and their advisors speak with clients, not down to them. It’s a departure from exclusivity, and a move toward empowerment.

Jean-Michel Basquiat, Hollywood Africans, 1983/205, Edition of 15

4. Digital-First Discovery

“NextGen generally turn to the internet… Social media plays a huge part. It is social endorsement amplified.”

Today’s collectors are more likely to discover a new artist on Instagram than in a museum. Influencers, artist reels, digital marketplaces, and online exhibitions are their primary sources of inspiration. They expect immediacy, visual storytelling, and frictionless access to information.

Maddox has built its entire advisory model to thrive in the digital realm. From a strong social media presence to digital catalogues, virtual tours, and in-depth artist analytics, Maddox speaks the language of this connected collector. Importantly, they also prioritize transparency: clear pricing, data-driven valuation tools, and straightforward purchasing pathways eliminate the opacity that once intimidated young buyers.

5. Experiences Over Objects (But Status Still Matters)

“Do they want stuff? Experiences and ‘fun’ are often more important… But a Picasso will always be a trophy.”

Minimalist lifestyles and the sharing economy have changed how younger generations view ownership. Many are wary of accumulating physical “stuff,” preferring to spend on experiences, travel, or digital art. Yet when they do invest in physical works, it's often because the piece says something about who they are, or what they stand for.

Maddox bridges this paradox by offering more than just art, they offer an experience of art collecting. Their exhibitions, collector events, and tailored consultations are immersive, engaging, and curated for cultural connection. And while they focus on emotional resonance, Maddox never loses sight of art’s symbolic, and financial, power as a status asset.

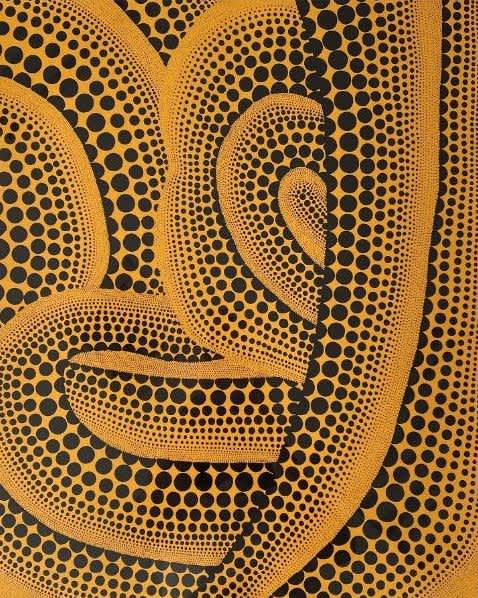

KAWS, Final Days, 2017, Bronze, Edition of 25

6. BONUS: Financial Intelligence and Strategic Investment

But there’s a sixth trait that deserves just as much attention. As Guillaume Cerutti, President of the Pinault Collection and Chairman of Christie’s, recently commented on this article through his Linkedin:

“The NextGen have access to an unprecedented level of information about the art market, particularly from a financial perspective… Portfolio diversification and return on investment — combined with a more detached attitude towards the personal enjoyment of owning art — is likely to influence the prices they are willing to pay.”

Cerutti highlights that this new breed of collectors is far more financially informed than previous generations. This is not a generation content to buy blindly. And they’re not just buying for love, they’re buying for strategy. Many come from entrepreneurial backgrounds or work in finance, tech, and innovation. Art, for them, is both cultural capital and financial asset. They're not only looking for the thrill of ownership, they want to know how a piece fits within a larger strategy of portfolio diversification and value appreciation.

Maddox’s data-driven approach is uniquely aligned with this mindset, offering robust data insights that track artist performance, market trends, and investment outlooks. From analysing how gallery representation impacts market value, to correlating institutional acquisitions with price appreciation, Maddox treats art as an asset class, without losing sight of its cultural and emotional power. For collectors interested in alternative models like fractional ownership, Maddox is actively exploring new platforms and partnerships to deliver flexible, forward-thinking solutions.

Conclusion

With billions in wealth moving to younger generations, the future of the art market hinges on its ability to evolve. The days of passive collecting are over. Today’s buyers are curious, connected, and cautious. They want art that moves them, advisors they trust, and data that backs their instincts.

Maddox is uniquely positioned to meet these demands, blending aesthetic vision with financial insight, and cultural relevance with digital fluency. For NextGens navigating a noisy market, Maddox doesn’t just sell art, it builds confidence, connection, and long-term value.

As the art world reckons with a generational shift, one thing is clear: Maddox isn’t following the future. It’s helping shape it.

Let us help you navigate the opportunity. For expert guidance and personalised assistance, contact Maddox Gallery today. Invest confidently in art, invest wisely with Maddox.

The value of investments can go down as well as up, and past performance is not guarantee of future performance. Return figures shown are gross; fees, including a 20% performance commission, may apply. Liquidity is not guaranteed. Terms, limitations, and withdrawal conditions apply. Minimum recommended investment is £20,000. Maddox Advisory is not FCA-regulated and does not give financial advice. Seek independent advice before investing.