As we release the new Maddox Investment Guide, we look at the history of art investment. Although for many, a new phenomenon, the concept of art as investment has been around for over 50 years and with half a century of recorded market resilience, both the short and long term performance of contemporary art remains extremely strong…

With a $1.7 trillion global marketplace, art is a profitable investment that consistently outperforms other asset classes such as FTSE 100 and S&P 100. Its low volatility and ability to hedge against inflation means that over the past decade, contemporary art has become a top choice of investors looking to diversify their portfolio. Yet, purchasing contemporary art as an investment is not a new concept. In fact, art as an asset class can be traced back to the late 1960s. As we release the new Maddox Investment Guide, we map the evolution of art as a passion investment from conception to the current day, demonstrating over half a century of solid returns.

BANKSY, CHOOSE YOUR WEAPON - SOFT YELLOW, 2010

1970s: Art As Investment

The idea of ‘art as investment’ originates from the late 1960s and early 1970s. Director of Sotheby’s London Art Business Master’s David Bellingham reportedly stated that when deciding the defining factor of the art market in the 1970s that “it would be how art developed as an alternative investment asset”. In 1973, couple collectors Robert and Ethel Scull sold their vast collection of art at auction at Sotheby’s – then known as Parke Benet. Achieving astronomical prices, many of the works, which they had bought for just a few hundred dollars a decade before, sold for tens of thousands of dollars. For example, Robert Scull bought Thaw (1958) by Robert Rauschenberg for $900 and it went under the hammer for $85,000. The high rate of return at the Scull sale drew the attention of both artists and connoisseurs alike and highlighted the potential of contemporary art as a store of wealth.

ANDY WARHOL, MARILYN (F.&S. II.22), 1967

1980s: Globalisation

The 1980s was defined by international consumerism and excess. The bull market that is associated with this decade extended to the art industry, with collectors buying art for eyebrow-raising prices. Changes in tax laws paired with an influx of wealthy Japanese investors saw international money pour into art collecting, boosting the art market and increasing prices. By the end of the decade, auction houses consolidated their role as clear market influencers, establishing global partnerships that expanded their footprint and increased awareness of the growing value of fine art.

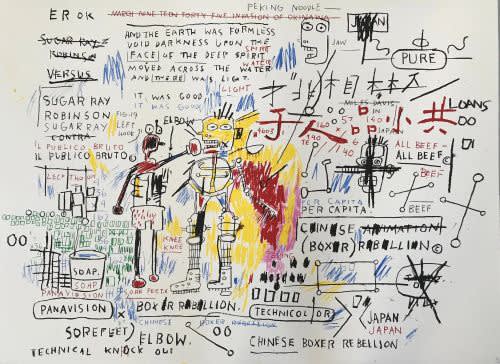

JEAN-MICHEL BASQUIAT, BOXER REBELLION, 1982/ 2018

Today: Digitalisation & The Buyer’s Boom

Fuelled by pandemic, there has been a move towards further digitalisation of the art world which has enticed new buyers globally. Over the past few years, auction houses have also turned to online sales to boost transactions and in 2021 alone, Sotheby’s online sales increased by $275 million. Yet, despite the effects of the pandemic seemingly decreasing, according to the 2021 Art Basel & UBS Report, 94% of auction houses surveyed expected online sales to increase even more over the next five years.

Over the past two years there has been a new influx of ultra-high-net-worth collectors wanting to invest in art for the first time. Last year, 44% of all bidders at Sotheby’s auctions were new buyers and 50% of all buyers across online-only and live auctions at Phillips were first time buyers, up from 32% in 2019.

DAMIEN HIRST, ANDROMEDA (H4-2), 2018

The Future of Art As Investment

Over the last fifty years, the landscape of the art market has completely transformed. Yet, history has consistently proven that the art market has and will always be, both resilient and ever-expanding. In the past five years alone, Maddox Art Advisory clients have achieved consistent double digit returns on their investments, with clients experiencing an average return of 24.3% in 2021. With digitalisation set to progress and new buyers continuing to enter the market, we look forward to the compelling future and endless possibilities of art as a passion investment.

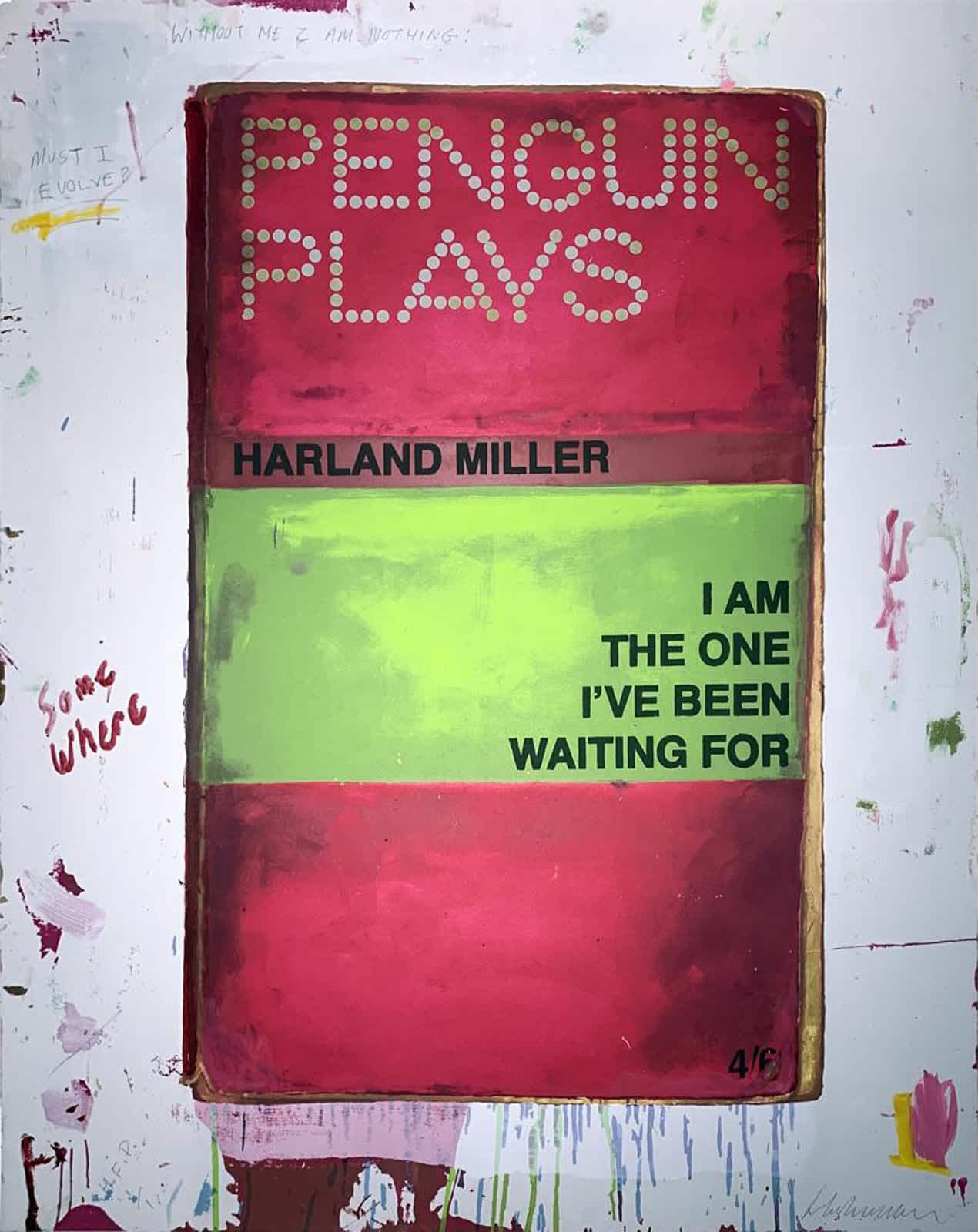

HARLAND MILLER, I AM THE ONE I’VE BEEN WAITING FOR, 2012