Trump’s tariffs are rattling global markets—a staggering $9.5 trillion (£7.39 trillion) was wiped from U.S. stocks in just three days. It’s a harsh wake-up call—traditional markets remain acutely vulnerable to geopolitical shocks. As volatility rattles sectors from tech to trade, savvy UK investors are looking for safer ground. One often-overlooked market is emerging as a clear winner: there are no tariffs on art from the UK.

Why Now, and Why Art?

Under the new Trump tariffs, a 10% base tariff now affects a broad swathe of goods entering the U.S.—with some duties soaring to 30%, impacting over 60 nations. But here’s the opportunity: Artworks—including paintings, prints, photos, and sculptures—are currently classified as "informational materials" and exempt from these tariffs (under 50 U.S.C. 1702(b), Chapter 97 and 49). This exemption applies unless they originate from already-sanctioned countries like China or Russia.

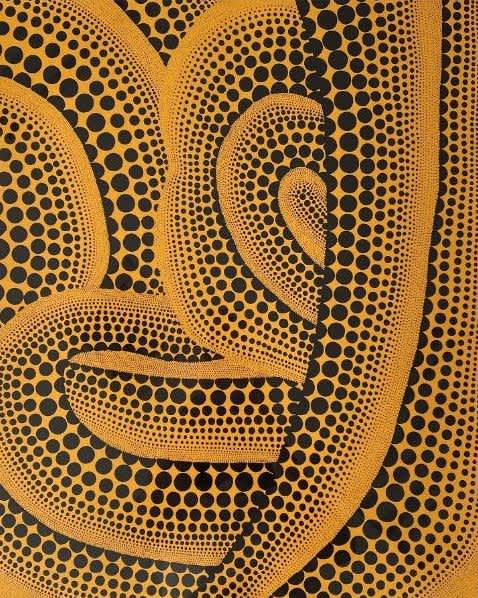

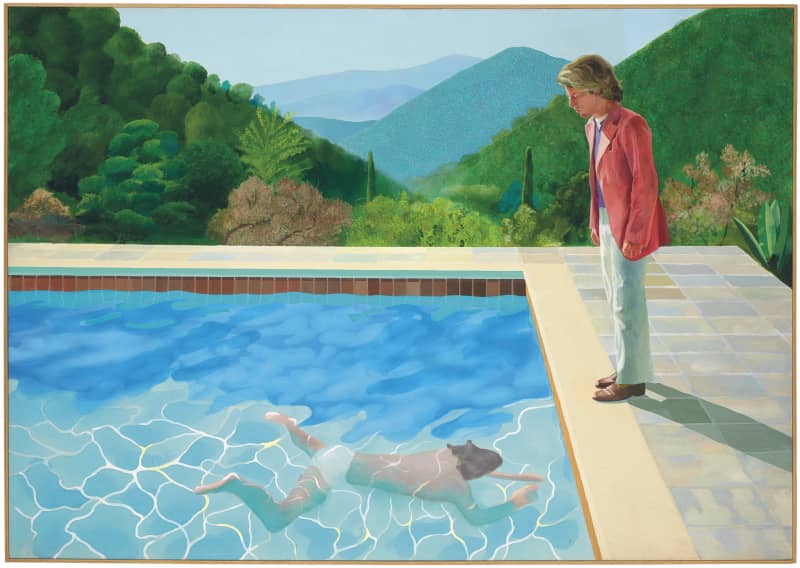

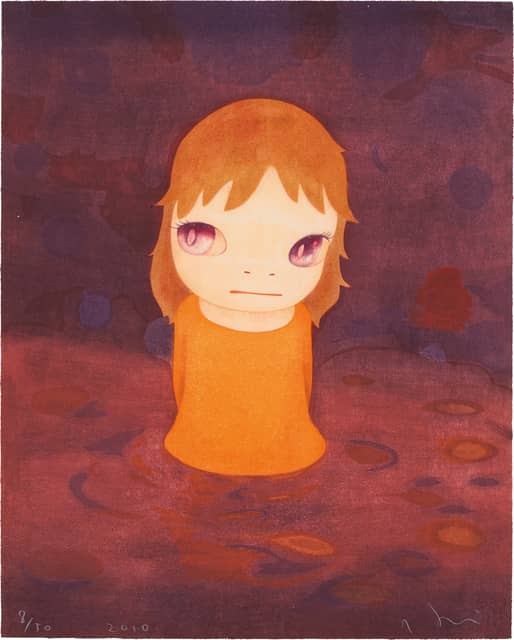

This places UK-based artworks in a uniquely powerful position. Works by Damien Hirst, David Hockney, Bridget Riley, Banksy, and Tracey Emin are fully exempt from art tariffs—regardless of where they’re shipped from—thanks to the UK origin classification.

In stark contrast, other alternative investments like watches, handbags, sneakers, and furniture are now fully subject to tariffs, which is already reflected in market sentiment. Shares in Nike, Adidas, and Puma have dropped 7% to 11% in the past 24 hours alone.

Diversify With Confidence: Art Has The Lowest Correlation To The Stock Market

Art doesn’t move with the markets—and that’s exactly what makes it so powerful in turbulent times. According to Citibank’s Global Art Market Disruption Report (2022) and the Deloitte & ArtTactic Art & Finance Report (2021):

-

Art has the lowest correlation to traditional asset classes like stocks and bonds.

-

85% of Wealth Managers now believe art should be included in wealth planning—up from 78% in 2016 and just 53% in 2014.

Why? Because the art market is influenced by factors independent of the global economy:

-

High-net-worth purchasing power

-

Limited supply

-

Global demand

-

Illiquidity, which helps insulate against rapid sell-offs

A Safe Haven With Proven Resilience

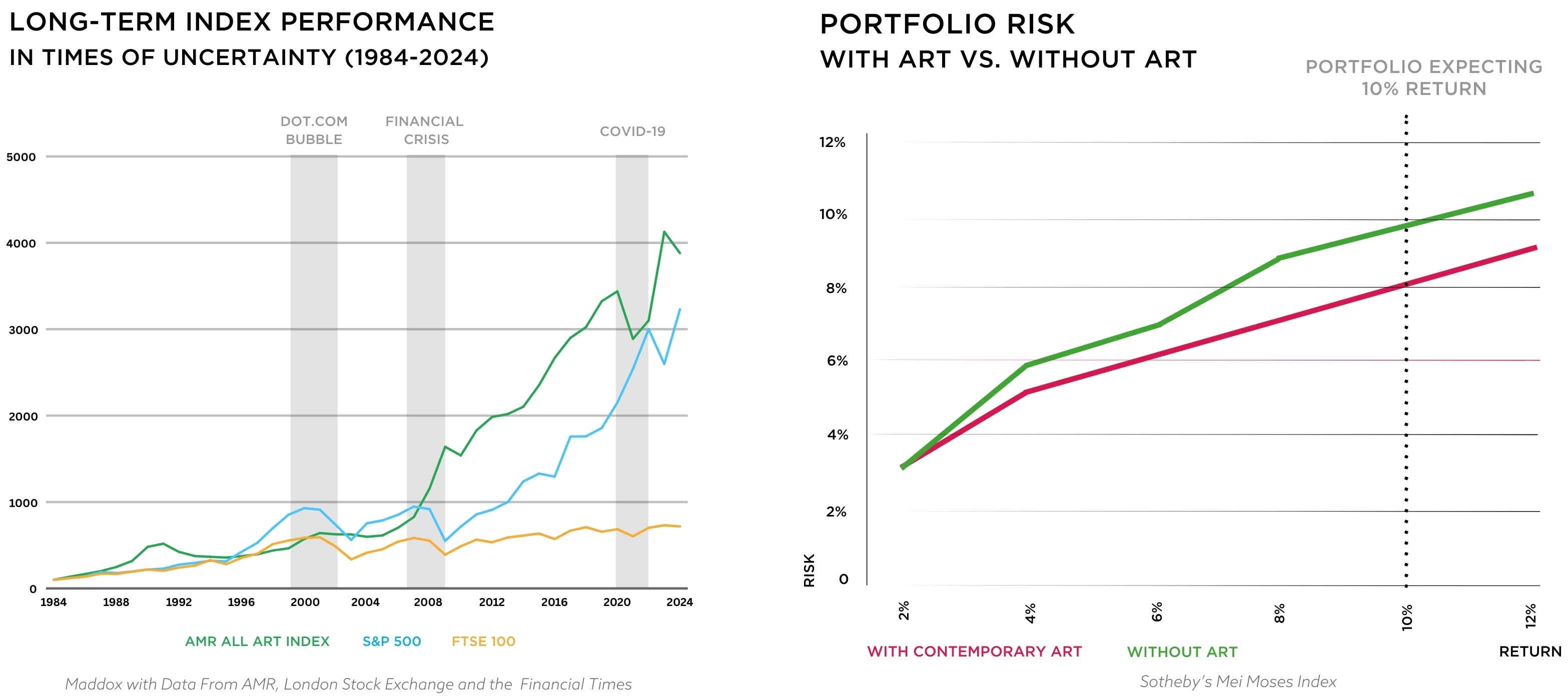

Art is not only uncorrelated with traditional financial markets—it has also proven historically resilient during economic downturns and global market volatility. During the 2008 financial crisis, while global equities plummeted by 46.1%, Damien Hirst’s Sotheby’s auction defied the trend, raising a record-breaking £111 million. Although art auction houses experienced a brief contraction, the market had fully recovered by 2010—two years ahead of the S&P 500’s rebound.

Supporting this, a study by Mei & Moses found that incorporating art into a portfolio targeting a 10% return reduced overall risk from 10% to 7%. Reflecting this long-term potential, Barclays Capital recommends allocating 10% of an investment portfolio to art for horizons of ten years or more.

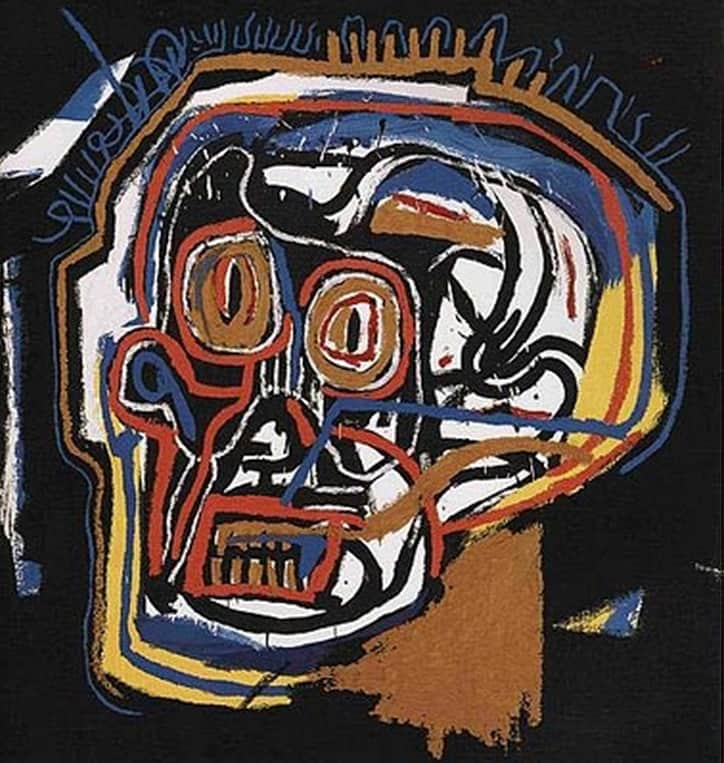

Invest From Just £20,000 - Proven Results, Real Returns

At Maddox Art Advisory, we provide access to British blue-chip art investments starting from as little as £20,000. Our tailored strategies delivered an average return of 25.8% over the past 9 years—navigating the Brexit recession, the Covid pandemic, and more macroeconomic events since 2015. Learn more in our detailed guide on How to Invest in Art.

Art isn’t just beautiful—it’s tariff-exempt, globally resilient, and in high demand. As markets reel and inflation bites, UK art stands out as a smart, stable store of value. Let us show you how to turn uncertainty into opportunity.

Let Maddox guide you through this rare window to invest in the world’s most enduring asset.