As global volatility reshapes traditional markets, three of the most influential industry reports—the 2024 Art Basel and UBS Global Art Market Report, the Artprice Report, and the Artnet Global Art Market Report—offer a rare window into the future of the global art market. This consolidated analysis from Maddox distills their findings into clear, actionable insights for collectors and investors looking to navigate the evolving art investment landscape with confidence.

In only five years, we’ve witnessed a global pandemic, revolving prime ministers in the UK, a change of government, the Russian-Ukrainian war, the intensification of Gaza's conflict with Israel and the re-election of Donald Trump as president of the US. Combined with new trade levies that have wiped trillions of dollars from global share prices, these events have created a volatile investment landscape. The need for stable, resilient assets has never been more urgent.

According to the latest findings in the Artprice report, Artnet report and Art Basel and UBS global art market report 2024, as traditional markets face increasing uncertainty, alternative assets such as art are proving their capacity to withstand economic turmoil. However, the art world itself has also evolved in response to these macroeconomic shifts. Bringing together these insights, this article serves as a comprehensive Art Market Report 2024, highlighting 5 key trends that are reshaping the art market and offering valuable insights on how to optimise your investment strategy in these turbulent times.

Whether it’s navigating the rise of affordable art, capitalising on the ongoing demand for blue-chip artists or tapping into the diversification of the world art market, Maddox Advisory is dedicated to guiding clients through this landscape, leveraging market intelligence and expertise to find the most promising art investment opportunities and build strong, future-proofed investment portfolios.

Now is the time to explore the potential of art as a strategic asset. Let Maddox help you turn today’s challenges into tomorrow’s successes.

#1. Market Resilience in Uncertain Times: Insights from the Art Basel and UBS Global Art Market Report

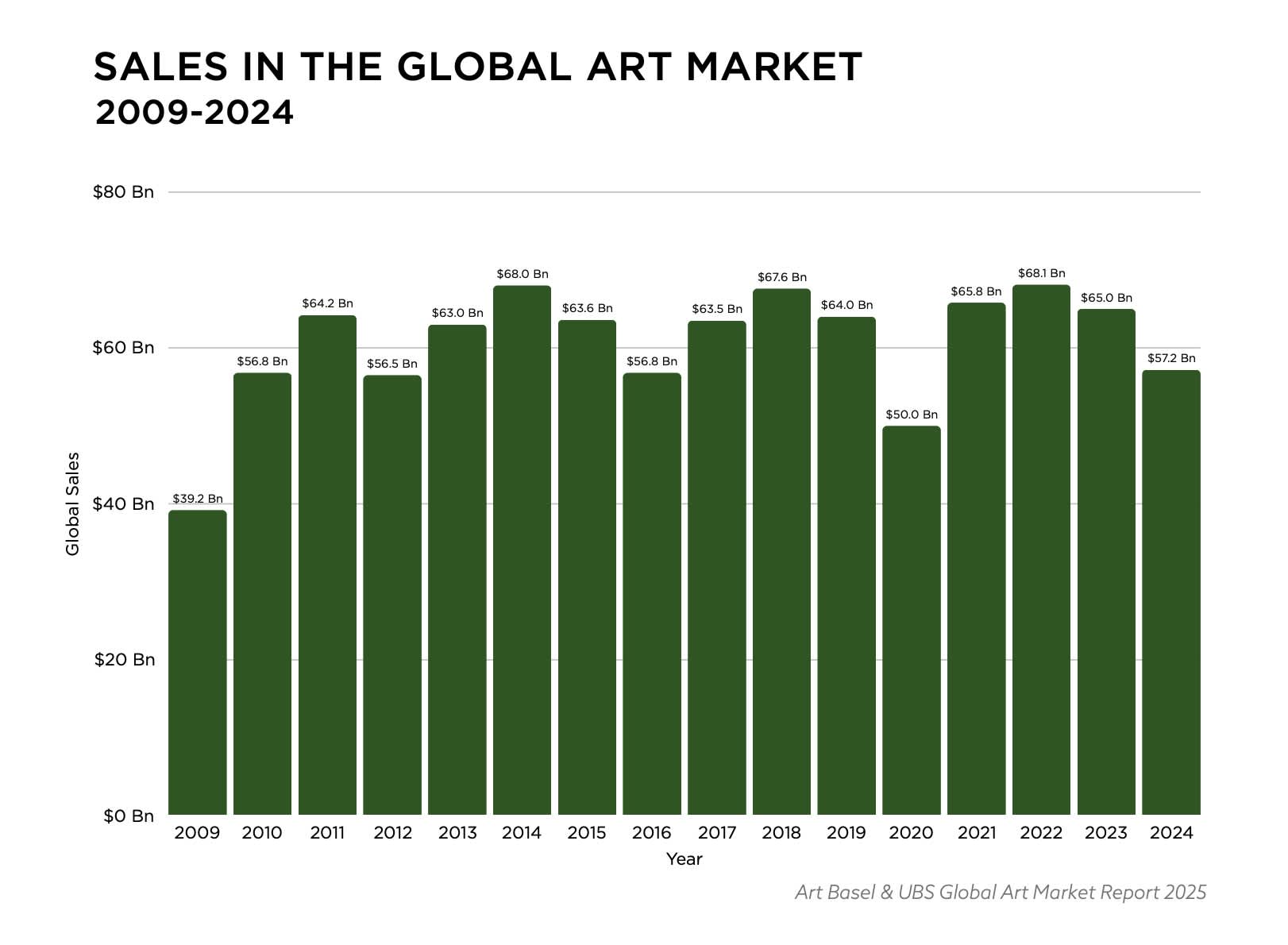

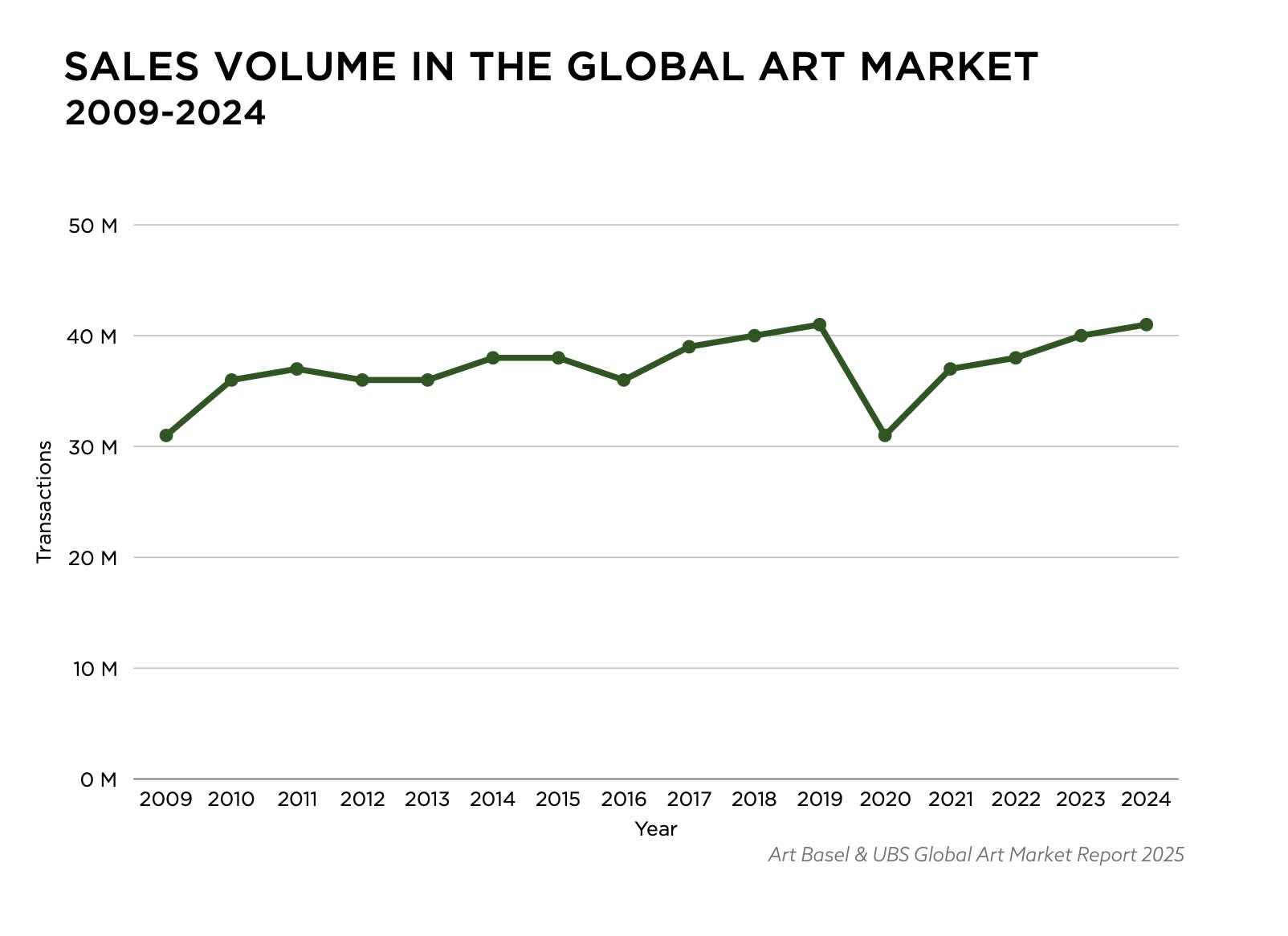

Despite a broader economic slowdown, the global art market showed resilience in 2024. As outlined in the Art Basel and UBS art market report, global art sales totalled $57.5Bn, down from $65Bn in 2023, with the affordable art market showing continued demand for accessibly priced works. The report also acknowledged the growing preference for private sales, with galleries and dealers the dominant method for purchasing art.

High-end sales many have cooled in 2024, but overall market activity expanded, with the number of transactions rising by 3% to 40.5 million, signalling a fundamental shift towards accessible price segments. This indicates a diverse and active market with the potential to offer stability in times of financial uncertainty.

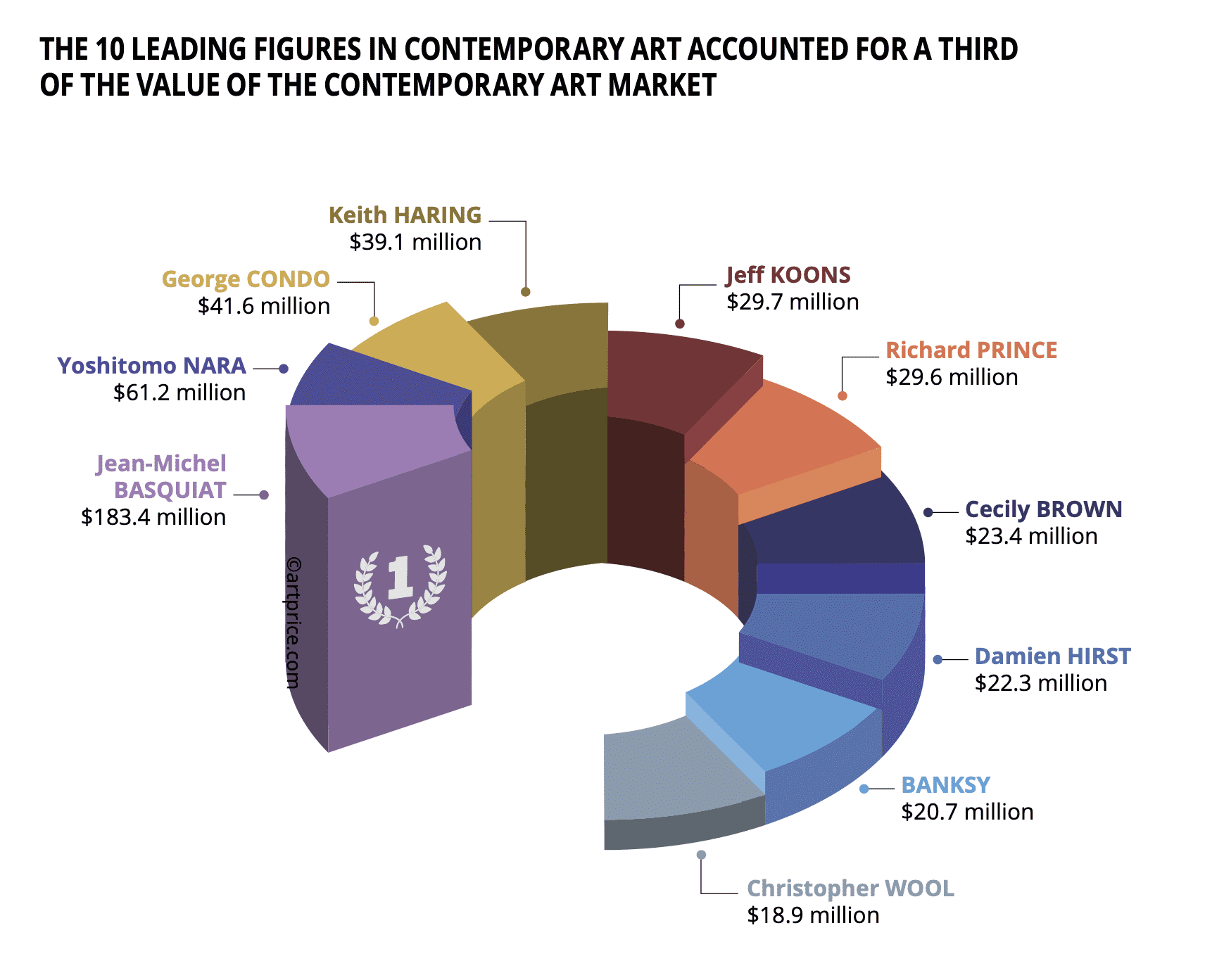

#2. Top Selling Artists 2024: Contemporary Icons Still Dominate in the Artnet and Artprice Reports

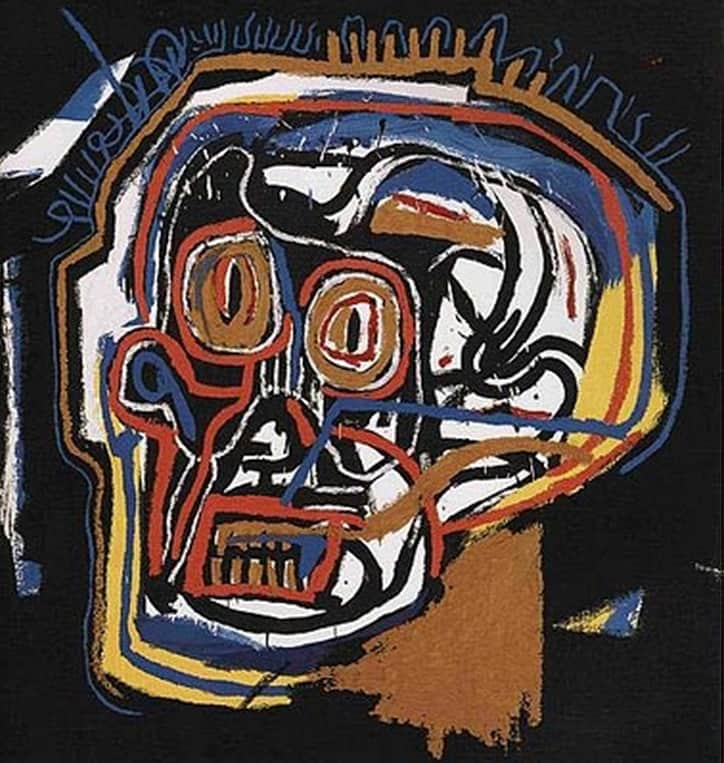

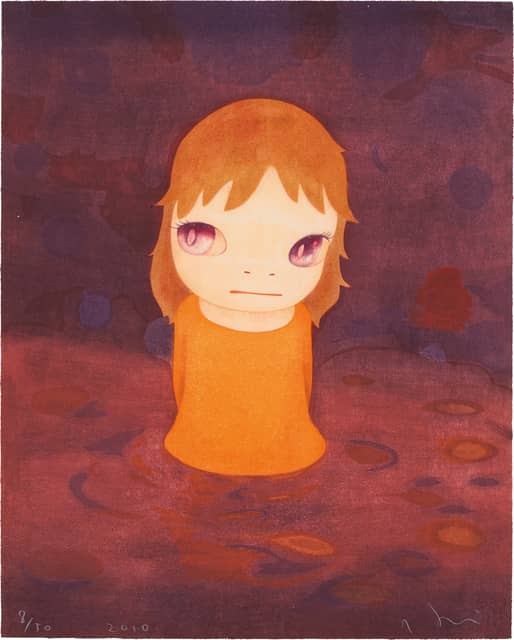

While the market softened at the highest price points, iconic Contemporary artists continued to perform strongly. Leading figures like Jean-Michel Basquiat, Keith Haring and Yoshitomo Nara generated solid sales—among the top selling artists 2024—underline their enduring appeal and value. This segment of the market remains a cornerstone for art investors seeking established names with long-term growth potential.

As part of its ongoing art market watch, the 2024 Artnet report revealed the most valuable Contemporary artist of the year was Jean-Michel Basquiat. The artist accounted for 12% of all sales of Contemporary art, with total revenue for his work reaching $183.4 million, with a 79% sell-through rate. Basquiat’s strong market presence underlines the consistent and sustained demand among collectors for his art.

The 2024 Artprice report also highlighted the burgeoning success of Pop artist Keith Haring, who experienced a 22% increase in auction turnover. The driver for this significant uptick in sales? Curated auctions and broad market enthusiasm, which helped raise his total sales in 2024 to $39.1 million.

In Artnet’s report, another trend emerged: a substantial influx of fresh artistic talent entered the auction market in 2024. With a total of 1,343 artists making their debut at major auction houses such as Sotheby’s, Christie’s and Phillips, and an impressive 96.5% sell-through rate, emerging voices in the Contemporary art market are being appreciated and collected at unprecedented levels.

#3. Affordable & Mid-Tier Contemporary Art is Booming: What the Artnet Report Reveals About Collector Behaviour

The affordable art market and mid-tier segments are flourishing, providing an exciting opportunity for art investors. With stable mid-tier demand and strong demand for prints priced under $5,000, this part of the market demonstrates potential for steady returns, especially as it continues to attract a broader base of collectors.

The figures reveal a thriving marketplace, with art sales under $5,000 seeing growth in both value (+7%) and volume (+13%), according to the UBS Art Market Report 2024. The market for prints is proving to be particularly buoyant, with the Artprice report revealing that sales of prints under $5,000 have surged by 79% since 2020, with 128,900 sold in 2024 alone.

The increasing importance of mid-tier investors was acknowledged in the Artnet report as key contributors to a healthier, more balanced global art industry. A resilient sector, the mid-tier ($100K–$1M) market experienced no dramatic declines in 2024. Driven more by personal passion and aesthetic appreciation than financial speculation, these collectors are continuing to actively engage with the art market.

#4. Young Collectors are Fuelling Market Transformation: UBS Art Report and Artnet

A significant shift is underway as younger generations continue to flood the art market. With the Bank of America predicting a global transfer of wealth estimated to reach $84 trillion in the next 20 years, the values, tastes and investment choices of this new audience will play a key role in determining the next wave of leading artists.

In just five years, the number of younger buyers participating at art auctions has more than doubled. According to the Artnet report, Millennials and Gen Z represented an increasingly large portion of fine art auction sales in 2024, comprising 25-33% of all bidders. This points towards a sustainable and long-term growth trajectory.

The UBS art market report highlights another of the art market trends that is only expected to grow in the years ahead: new buyers are entering the market at remarkable rates, driven by these young cohorts of collectors. Among all online art sales in 2024, 46% were made by first-time collectors, with private dealers enjoying a 50% uplift in new clients as a consequence. These groups are expected to continue driving demand within the Contemporary and affordable art market in the years ahead.

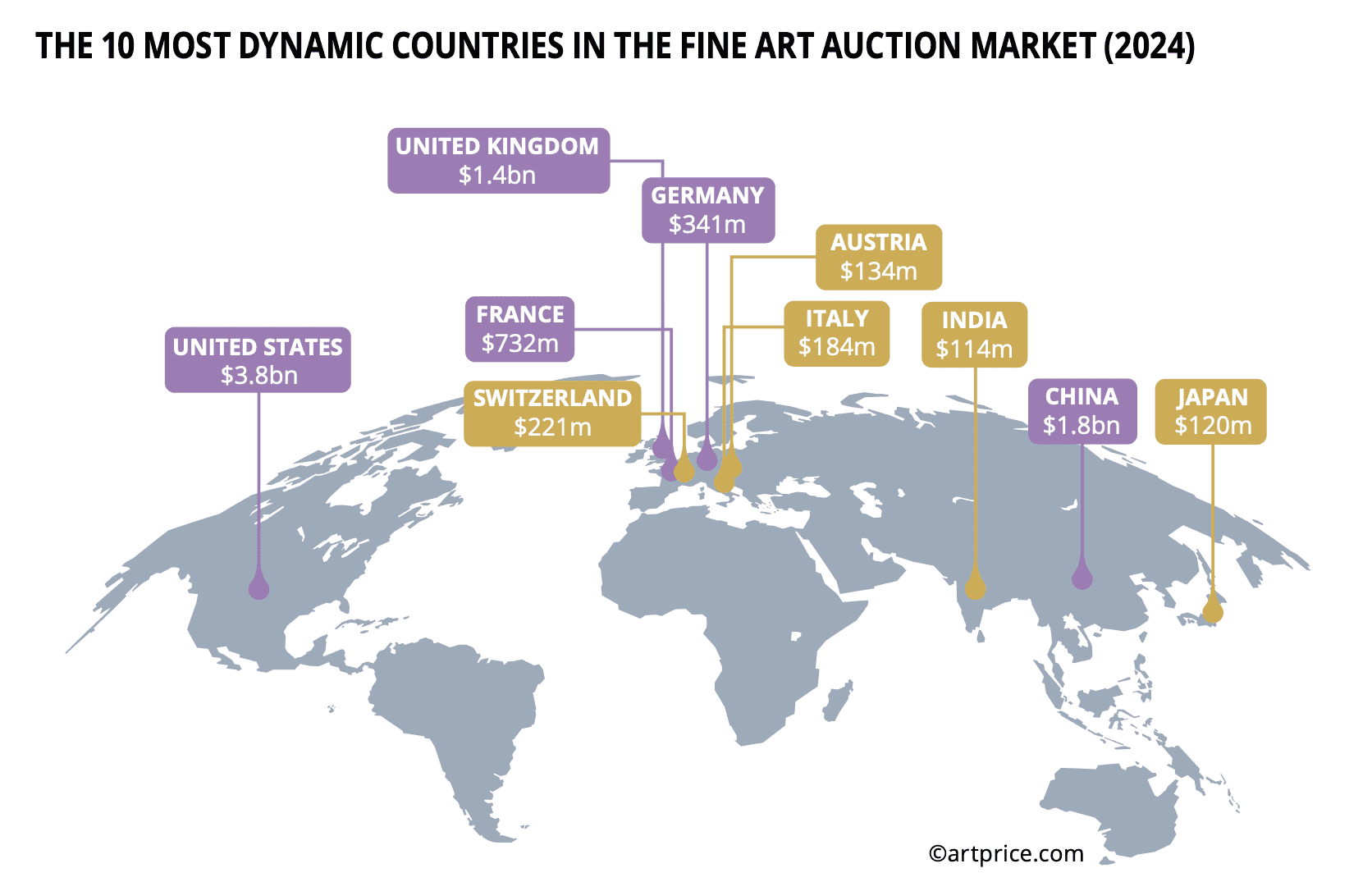

#5. Global Diversification: Regional Shifts in the Art Basel and Artnet Reports

As the UK art market asserted its strength in 2024 as the third most vibrant worldwide, accounting for 13% of all global transactions according to the Art Basel report, geographical diversification continued apace. Emerging centres, like the Middle East art market, are experiencing substantial growth. Alongside, the diversification of artists and collectors globally is creating new opportunities beyond traditional Western centres, with regions such as Saudi Arabia and the UAE becoming vibrant art hubs.

Auctions of art at Christie’s in the Middle East reflect the growing sense of dynamism in the region. Artnet reports that since 2020, sales have surged by 298%, with 30% of auction participants in these countries under 40, indicating substantial long-term growth potential.

Conclusion: The Future of Art is Global and Diversified

As the Artprice, Artnet and Art Basel and UBS art report for 2024 make clear, the art market is in the process of transforming. Long-term structural changes are redrawing the landscape, offering fresh opportunities for investors who are ready to adapt.

From the rise in mid-tier and affordable art to the continued dominance of blue-chip artists, the market is proving both resilient and responsive. Demand is no longer driven solely by trophy hunters at the top end. Instead, a new generation of digitally fluent, globally minded and culturally curious buyers is fuelling market momentum from the ground up.

Geographic diversification is another powerful force. While traditional markets like the UK remain strong, regions such as the Middle East are emerging as major players, powered by younger collectors and local cultural investment. These developments point toward a more globally connected, culturally inclusive and demographically diverse market than ever before.

Meanwhile, private sales and gallery transactions are on the rise, reflecting a shift towards more discreet, relationship-driven modes of buying—another sign of the market’s maturing sophistication.

In short, the art world is undergoing a structural evolution: more accessible, more global and more digitally engaged. For investors, this means a broader range of opportunities and the chance to build portfolios that are not only resilient in the face of economic volatility but also attuned to the cultural and generational shifts redefining value in 2025 and beyond.

The value of investments can go down as well as up, and past performance is not guarantee of future performance. Return figures shown are gross; fees, including a 20% performance commission, may apply. Liquidity is not guaranteed. Terms, limitations, and withdrawal conditions apply. Minimum recommended investment is £20,000. Maddox Advisory is not FCA-regulated and does not give financial advice. Seek independent advice before investing.