The global art market is undergoing a profound shift as new hubs emerge in the UAE, Saudi Arabia, India, and Singapore. Once considered peripheral, these regions now attract collectors, galleries, and auction houses seeking fresh art investment opportunities.

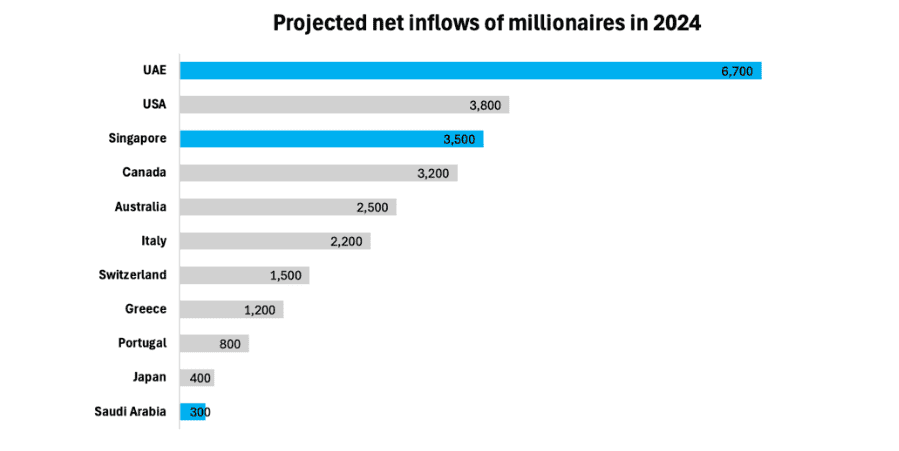

Ambitious government initiatives, burgeoning private wealth (India alone boasts 868,660 millionaires, Saudi Arabia 351,855, Singapore 333,204, and the UAE 202,201), and world-class cultural infrastructure have combined to create vibrant ecosystems rivalling traditional centres like New York and London.

Source: Henley Private Wealth Migration Report 2024

Catalysts of Growth

-

UAE Art Market: The launch of Art Dubai and Abu Dhabi Art indicates high-level commitment to art fairs. Art Dubai drew over 30,000 visitors in 2019, including UAE-based, regional, and international collectors, curators, and nearly 100 visiting museums and institutions. Its 2025 edition featured 120 galleries from more than 60 cities. Meanwhile, the UAE government has committed nearly $5.3 billion to arts and culture, significantly boosting local infrastructure and programming in the global art industry.

-

Saudi Arabia: Vision 2030 has similarly prioritised the arts. The inaugural Islamic Arts Biennale in Diriyah welcomed over 425,000 visitors in 2023. Landmark events and high-profile acquisitions have positioned the kingdom prominently within the Middle East art market.

-

India: Rapid economic expansion has created new millionaires drawn to art as both an investment and a status symbol. The India Art Fair (2024) hosted a record 109 exhibitors, including 72 galleries, 23 institutions, and seven debut design studios, with VIP attendance rising by 30% on opening day—reflecting strong global interest and highlighting important art market trends.

-

Singapore: Benefiting from political stability and a business-friendly environment, Singapore has capitalised on Hong Kong’s recent uncertainties to host ART SG, which recorded 45,303 visitors in January 2024, marking a significant step forward in the world art market.

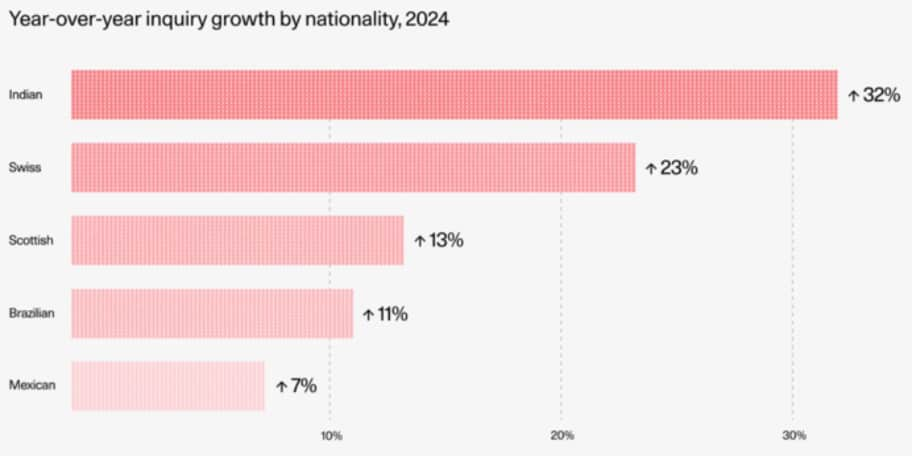

Source: Artsy Market Recap 2024

Building Market Infrastructure

Robust infrastructure underpins these markets' rise. The UAE features flagship projects such as Louvre Abu Dhabi and the upcoming Guggenheim Abu Dhabi alongside dynamic private venues. Saudi Arabia is developing new national museums and staged its first international auction in Diriyah. India combines established public institutions with rapidly growing private museums like the Kiran Nadar Museum and Ambani Cultural Centre, supporting both domestic and international fine art auction sales. Singapore’s National Gallery saw over 2 million visitors in 2024, up from 1.4 million in 2022/23, itself a 72% increase from the previous year. Additionally, the Gillman Barracks gallery cluster and high-security Freeport storage create an integrated ecosystem for exhibition, sale, and collection management.

Source: The Art Newspaper Visitor Figures 2024

Financial Incentives

Tax advantages play a crucial role. The UAE imposes 0% personal income and capital gains tax on art, while Singapore similarly levies no income or capital gains tax and minimal import duties. Its Freeport allows bonded storage without triggering goods and services tax. Gulf sovereign investments, such as ADQ’s US $1 billion minority stake in Sotheby’s, underline regional confidence in art as an asset class. Saudi Arabia is exploring similar free zones, and its art tourism market is forecast to reach $1.3 billion by 2030 (Horizon Research).

New Collector Profiles

A fresh wave of wealthy, younger collectors is reshaping demand. In the Gulf, wealth from diversified economies fuels interest in art as cultural philanthropy and legacy-building. Indian collectors include traditional industrial families and startup entrepreneurs. Meanwhile, Singapore attracts ultra-high-net-worth individuals from across Asia, drawn by stable governance and excellent global connectivity. Collectors across these regions increasingly view art as both passion and strategic investment, merging personal aesthetics with portfolio diversification.

Auction Houses and Private Sales

Major auction houses have expanded into these regions. Christie’s and Sotheby’s maintain offices and specialist teams in Dubai, Riyadh, Mumbai, and Singapore. They balance headline public auctions with discreet private sales, catering to clients’ preferences for confidentiality. Christie’s reports that 15% of its new clients over the past three years have come from the Middle East and Africa. Sotheby’s inaugural Diriyah sale showcased Western blue-chip works alongside pioneering Arab artists. In India, auction houses emphasise private sales and client outreach, leveraging regional expertise to source and sell artworks locally and internationally. Singapore, reclaiming its role as an Asian art crossroads, hosts periodic evening sales and private viewings aimed at Southeast Asian buyers.

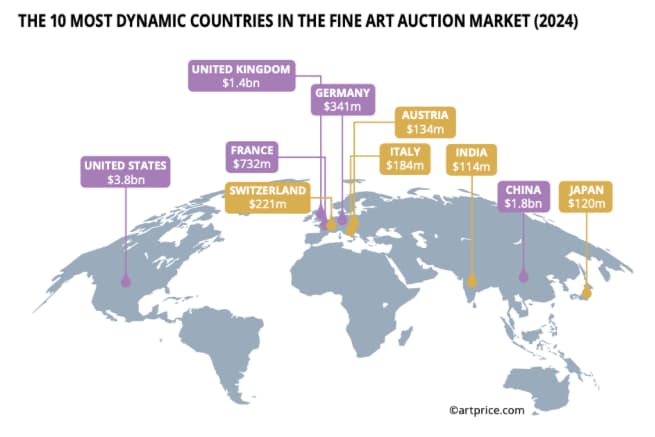

Nearly 700 cities and a thousand auction houses are active on the global art market.

Source: Artprice Art Market Report 2024

Outlook and Opportunities

The outlook for these emerging art markets is exceptionally positive. Continued government investment through museums, biennales, and cultural partnerships will sustain growth. Young collectors’ enthusiasm for art and collectibles promises further innovation, while global galleries and advisors expand their presence to capture regional demand. As economic power shifts, the art world's centre of gravity broadens, providing affordable art market segments alongside high-end opportunities, offering exciting prospects for both established and prospective investors.

At Maddox Gallery, we specialise in guiding you through this shifting landscape, ensuring that your art transactions remain confidential, efficient, and advantageous. Connect with our expert Maddox Art Advisors today and discover the benefits of private art sales—where discretion meets opportunity in a rapidly evolving market.

The value of investments can go down as well as up, and past performance is not guarantee of future performance. Return figures shown are gross; fees, including a 20% performance commission, may apply. Liquidity is not guaranteed. Terms, limitations, and withdrawal conditions apply. Minimum recommended investment is £20,000. Maddox Advisory is not FCA-regulated and does not give financial advice. Seek independent advice before investing.