As Baby Boomers begin passing unprecedented sums to their heirs, the global art market is poised for profound change.

This Great Wealth Transfer—the largest in modern history—will see trillions of pounds and countless works of art move from older generations to Millennials, Gen X, and Gen Z over the next two to three decades. For established collectors and newcomers alike, this shift offers fresh art investment opportunities, evolving tastes, and a more diverse collector base.

An Unprecedented Flow of Wealth

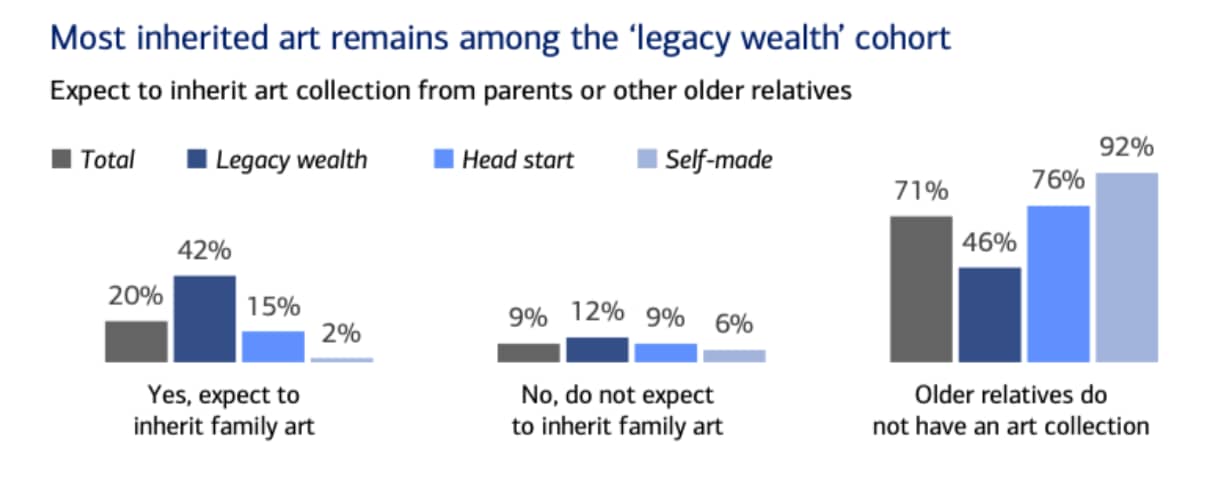

In the United States alone, roughly $80 to $85 trillion in assets is projected to transfer between generations by mid-century, with significant portions destined for heirs aged between their 20s and 50s. While much of this wealth will initially flow between spouses, a substantial share—estimated at 20% of wealthy Americans' inheritances—will include family art collections. Globally, ultra-high-net-worth individuals hold upwards of $2 trillion in art and collectibles. Even a fraction of this transfer involving art could result in hundreds of billions of pounds' worth of works entering the market.

Source: Bank of America Study of Wealthy Americans 2024

Art as an Asset: How Much Will Move?

High-profile estate sales already indicate what is to come. Collections from renowned collectors, such as the late Paul Allen, have achieved record-breaking results in the hundreds of millions, sometimes billions. However, not every heir chooses to sell immediately; surveys suggest that over 70% retain at least some inherited artworks due to sentimental, tax, or trust-related reasons. Nevertheless, the volume of art entering the market will substantially increase, benefiting galleries and auction houses involved in secondary-market fine art auction sales.

Generational Shifts in Taste

A crucial question is whether younger collectors will cherish the same artists as previous generations. Traditionally, Boomers and Gen X favoured 20th-century masters, Impressionists, Modernists, and Abstract Expressionists. Millennials and Gen Z, however, lean towards edgier late-20th and 21st-century artists, digital artworks, and socially conscious creators. Popular figures such as Basquiat, KAWS, and Banksy attract fierce competition, while female artists and artists of colour are receiving overdue recognition, aligning with younger collectors’ values. Despite these shifts, blue-chip classics remain robust, with masterpieces by Hockney, Warhol, and Kusama continuing to attract global bidders, ensuring top-tier works retain their market standing.

Opportunities and Growth

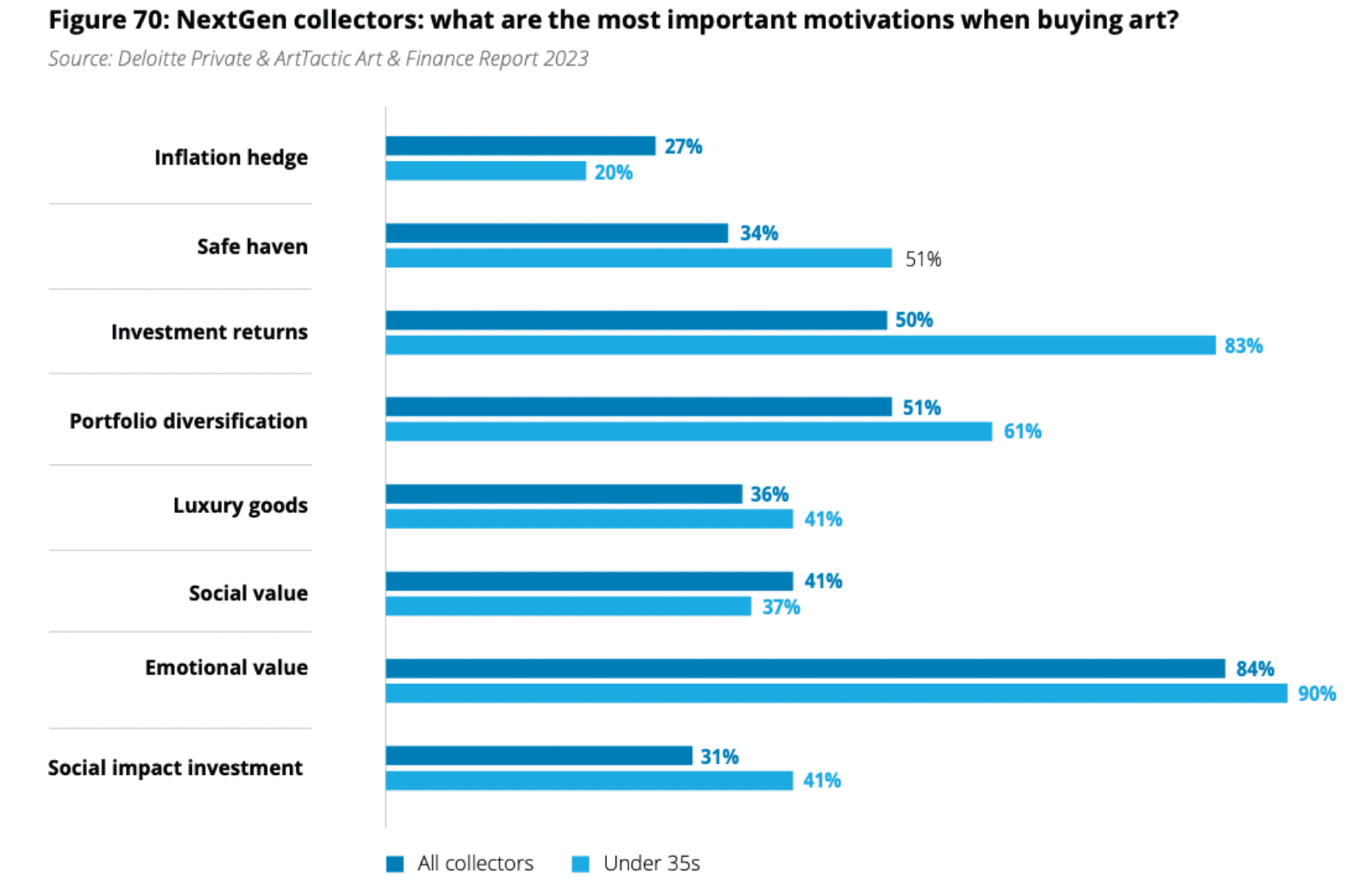

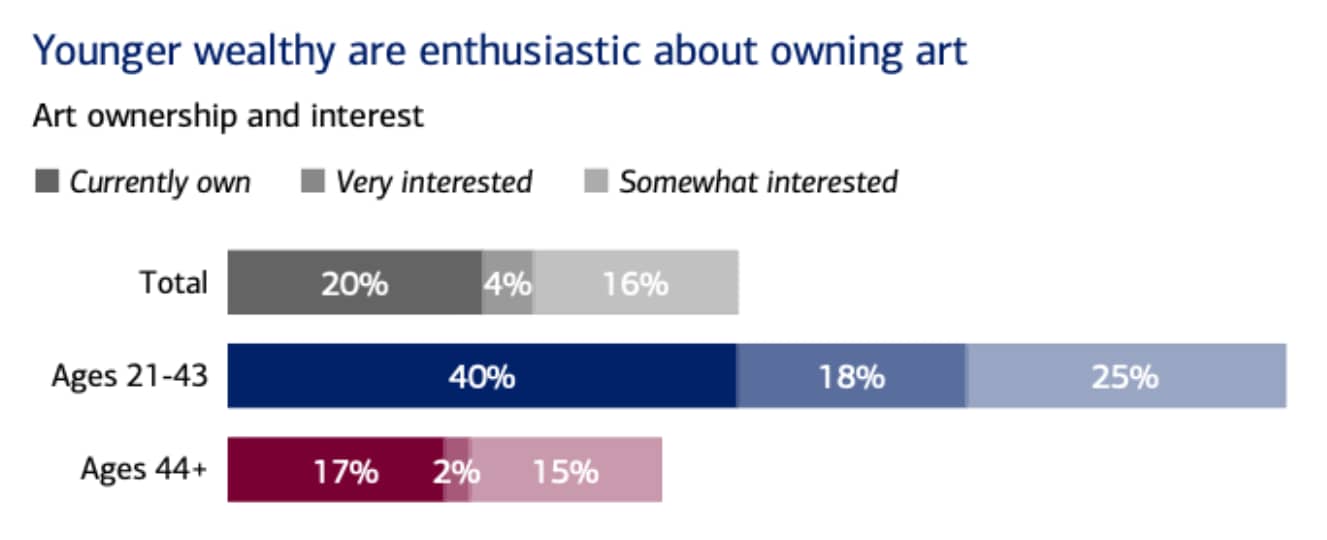

Overall, the wealth transfer positively impacts the global art industry. Surveys indicate that over 80% of wealthy individuals under 40 either collect art already or plan to start. This influx promises fresh demand across all price segments, particularly in the affordable art market. Online viewing rooms, social media-driven discoveries, and digital auctions broaden access, expanding the collector base beyond traditional gatekeepers. Auction houses now frequently combine fine art with luxury watches, cars, and fashion collectibles in single sales—appealing to younger buyers whose interests span multiple lifestyle categories. Emerging markets in the Middle East, Asia, and Latin America continue to cultivate new collectors through fairs, museum projects, and satellite auctions, further diversifying and invigorating the world art market.

Financial institutions are also adapting; an increasing number of wealth managers recommend art as a portfolio diversifier. Specialised services, from art-backed lending to estate planning, are expanding. Younger heirs, particularly comfortable leveraging art assets financially, view them as both cultural treasures and strategic investments.

A Bright Horizon for Collectors

The Great Wealth Transfer represents more than a shift in assets—it signifies a cultural handover. As Millennials and Gen Z assume their roles as art owners, their collections will increasingly reflect contemporary values, digital innovation, diversity, and social engagement. Established collectors can expect a larger pool of potential buyers for artworks they wish to sell, while first-time buyers gain unprecedented access to both private and public markets. Galleries, dealers, and auction houses proactively engage younger audiences through educational initiatives, social events, and digital platforms, making art collecting accessible and exciting.

Source: Bank of America Study of Wealthy Americans 2024

In this evolving landscape, both seasoned enthusiasts and newcomers stand to benefit. The art market’s foundational passion, creativity, and cultural value remain intact, even as tastes evolve and new technologies emerge. With trillions in wealth transferring into younger hands, the future of art collecting promises to be more inclusive, dynamic, and vibrant than ever before.

At Maddox Gallery, we specialise in guiding you through this shifting landscape, ensuring that your art transactions remain confidential, efficient, and advantageous. Connect with our expert Maddox Art Advisors today and discover the benefits of private art sales—where discretion meets opportunity in a rapidly evolving market.

The value of investments can go down as well as up, and past performance is not guarantee of future performance. Return figures shown are gross; fees, including a 20% performance commission, may apply. Liquidity is not guaranteed. Terms, limitations, and withdrawal conditions apply. Minimum recommended investment is £20,000. Maddox Advisory is not FCA-regulated and does not give financial advice. Seek independent advice before investing.