Global market volatility and recent discussions surrounding the art market have focused on declining auction results and cautious sentiment. But when you look beyond the surface, a different picture emerges—one that’s far more nuanced and, ultimately, optimistic.

The reality is that auction data represents only a sliver of a much larger, increasingly complex ecosystem. Fine art auction sales are booming, top-tier works are returning to the market, economic conditions are improving, and collectors are regaining confidence. To truly understand key art market trends—and where emerging art investment opportunities lie—it’s essential to look beyond the headlines. Here’s what you need to know to get ahead of the wave.

1. The 4% Myth of Auction Sales

Over the last three years, recent art market watch reports have leaned heavily on “doom porn,” predicting the art market’s demise based on dropping auction totals. However, these figures frequently neglect one critical fact: they are based solely on auction sales, accounting for only a small fraction—about 4%—of the global art market, which is estimated to be traded annually out of a $1.7 trillion industry.

© ArtTactic, 2025

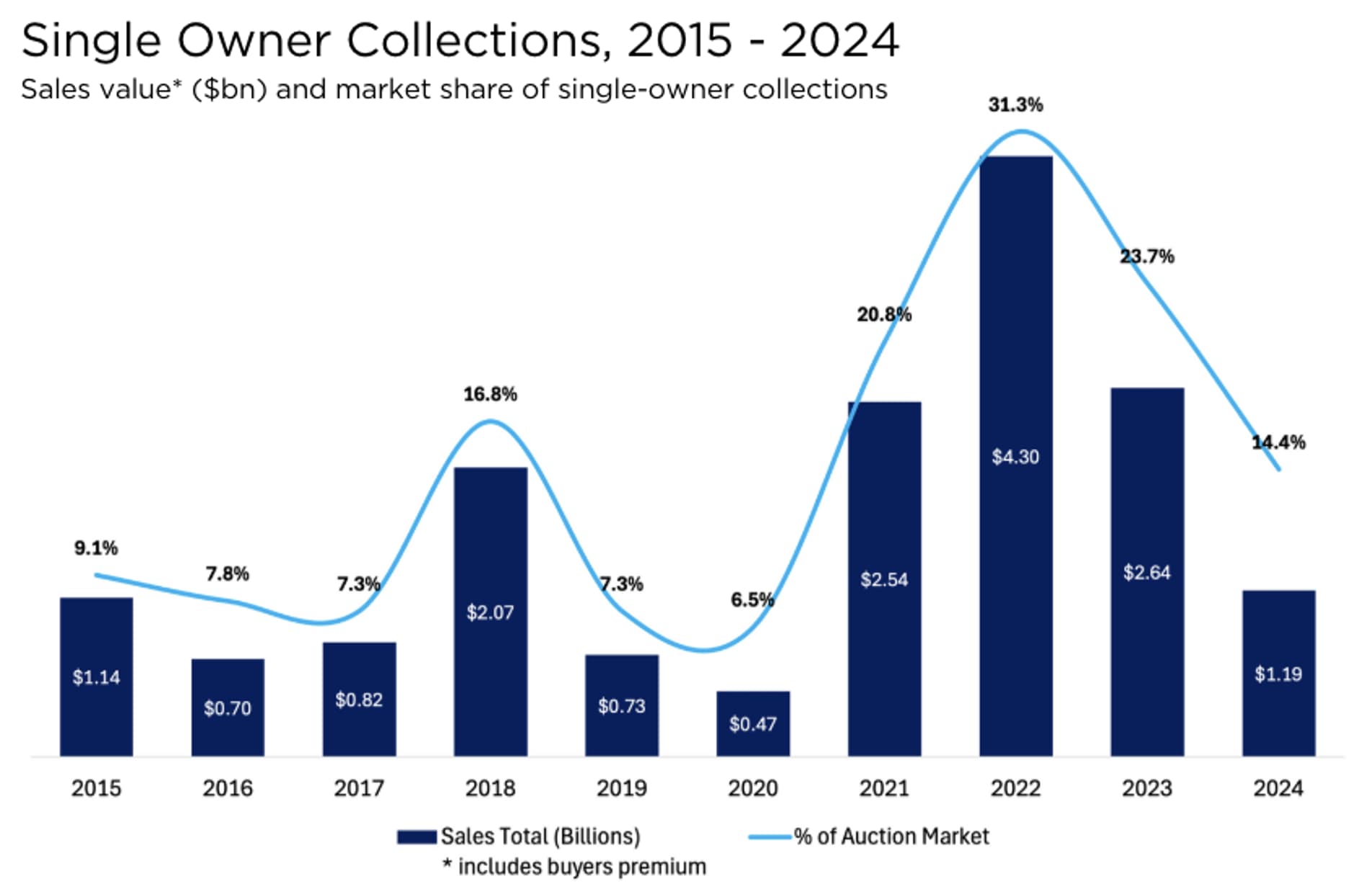

That 4% is primarily impacted by what is for sale, not by consumer demand. When major estates or “trophy” lots are absent, totals fall—not because demand is weak, but because the best pieces aren’t accessible. For example, in 2022, single-owner collections accounted for more than 30% of global auction sales. Without these big-name consignments, the market appears down on paper, but values for high-quality works remain strong in practice. What we’re actually seeing is a supply slowdown, not a price fall. Reports that fail to track consistent pricing for top-tier artworks and increased competition in private transactions, when purchasers secretly acquire blue-chip works away from the auction spotlight. However, these poor public outcomes have an impact on fair market valuations, as they frequently use public results as comparables.

In reality, while overall auction volumes fell in 2024, private sales increased by 14% to $4.4 billion. Christie’s private transactions increased 41% to $1.5 billion, the biggest since the epidemic boom, while Sotheby's private sales reached a record $1.4 billion, up 17% year on year. These figures demonstrate that demand has remained stable. It’s just been relocated offstage.

2. Bullish Signals in Today’s Art Market

One reason total sales may appear muted is the growing financialisation of the art market. In today’s environment, galleries and dealers resist lowering prices—not out of greed, but because a price decrease is regarded as a value cut.

According to New York art advisor Heather Flow: “It’s very hard to decrease prices because in a financialized market, decreasing prices implies decreased value.” A work that once sold for $500,000 sets the benchmark for all similar works by that artist. If another one sells at $400,000, that becomes the new reference point—so most dealers and collectors would rather hold onto inventory or lend to institutions than accept lower prices.

This pricing discipline maintains confidence in long-term value, even if it means short-term liquidity suffers. When both buyers and sellers hesitate—buyers waiting for discounts and sellers holding firm—sales volume drops. But again, the key is that prices remain consistent, particularly for high-quality, investment-grade artworks.

3. Political & Economic Tailwinds: Rate Cuts and Rising Wealth under Trump’s Administration

Looking beyond the art world, the broader macroeconomic environment is becoming more favourable for art investment. With President Trump back in office in 2025 and a proposed $4.5 trillion in tax cuts on the horizon, HNWI are feeling flush once more. Following a recent stock market dip in Q1, billionaires gained $304 billion in a single day, the largest wealth increase ever recorded. We’re also seeing the first cut in interest rates in the UK, and the U.S. Federal Reserve is expected to follow suit under Trump’s tariffs.

Lower interest rates mean more liquidity and lower borrowing costs. For high-net-worth collectors, this creates ideal conditions to invest in illiquid assets like fine art. These shifts tend to drive activity at the top end of the market, where art functions not only as a cultural asset but also as a hedge against inflation and a store of value.

4. Blue-Chip Icons Return, and So Does Market Confidence

The most exciting signal of change? Great art is coming back to market.

New York’s auction week marked the high-profile return of single-owner sales from key figures such as art dealer and tastemaker Daniella Luxembourg, renowned gallerist Barbara Gladstone—who represented over 70 artists and estates—and Barnes & Noble founder Leonard Riggio.

The May 2025 auction season across Christie’s, Sotheby’s, Phillips, and Bonhams generated approximately $1.28 billion, surpassing estimates by 23%. Of the 1,777 lots offered, 84% were sold, making it one of the most anticipated and successful auction weeks in recent years. This strong performance came despite the last-minute withdrawal of some overpriced, non-guaranteed lots.

Women and emerging artists continued to gain momentum, reflecting a generational and demographic shift in collecting. Eleven new artist auction records were set, five of them by women, including Surrealists and contemporary figures. Notable names include Marlene Dumas—now the highest-priced living female artist—alongside Dorothea Tanning, Remedios Varo, Louis Fratino, Simone Leigh, and Emma McIntyre.

The lower and mid-tier art market is experiencing a notable upswing, fuelled by a new wave of younger and first-time collectors. This momentum is especially visible in day sales, which recorded an impressive average sell-through rate of 82%—the highest in recent years. Traditionally seen as a more accurate barometer of market conditions, these longer-format auctions now reveal a resilient market that is increasingly oriented towards emerging artists and broader collector participation.

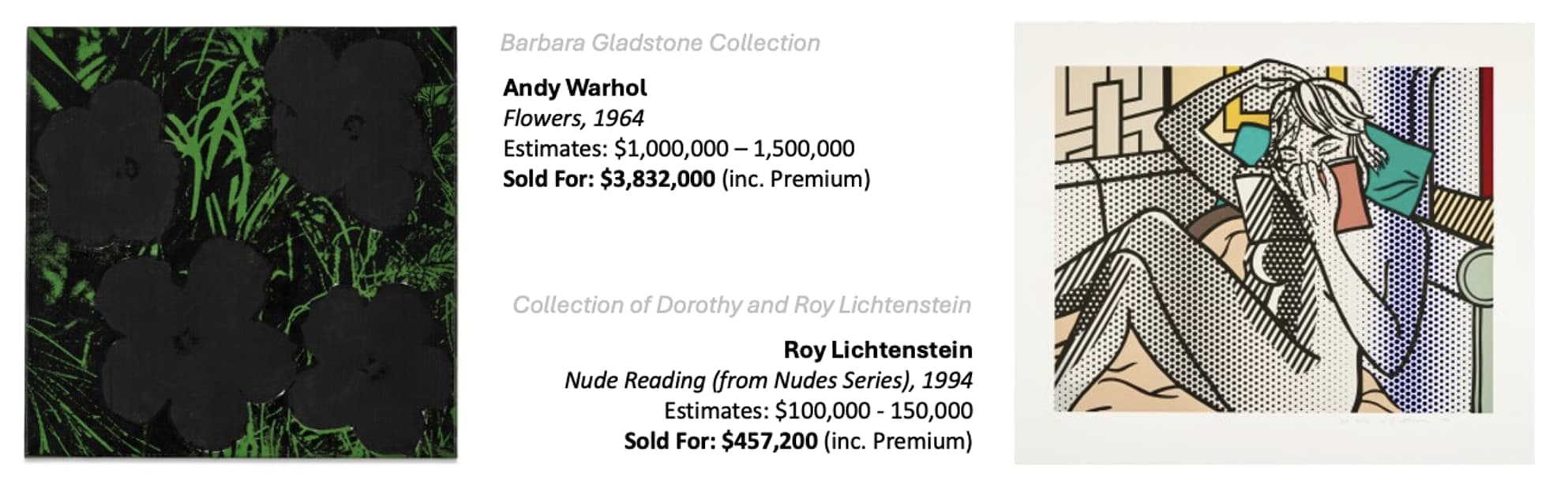

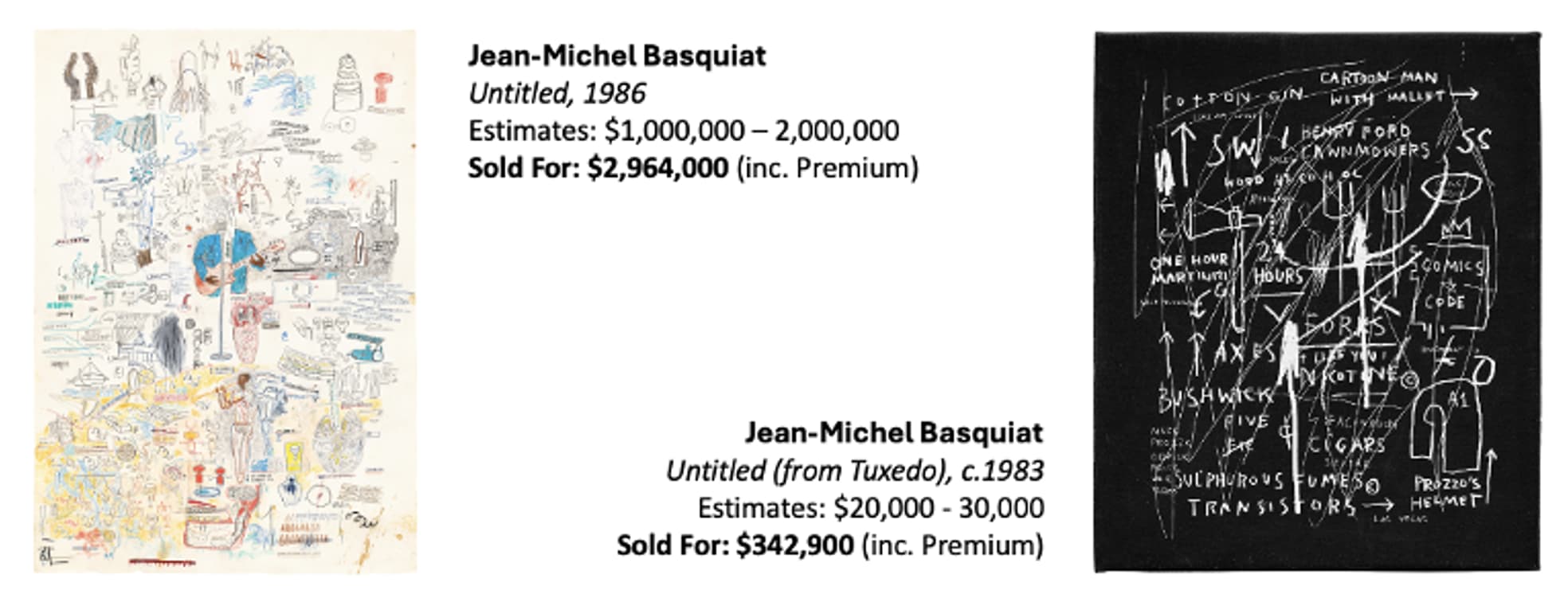

Nude Reading, an AP screenprint from the collection of Dorothy and Roy Lichtenstein and held back by the estate until now saw enthusiastic bidding and saw the sale price more than double its high estimate, selling for a whopping $457,200 at Sotheby’s. Over at Phillips, another work that experienced competitive bidding and saw prices soar was Jean-Michel Basquiat’s Untitled (from Tuxedo), a small test print that the artist made when creating Tuxedo, a monumental silkscreen on canvas work printed in an edition of 10. The work sold for $342,900 more than 10 times it’s high estimate! Illustrating the demand that Basquait’s work commands. Another Basquiat that caught collectors eyes was a wonderful Untitled work on paper from 1986—a fiercely spontaneous work on paper, where densely layered symbols from anatomy and jazz to fragmented text, merge figuration and abstraction. Its partial erasures and unpolished passages capture the raw immediacy of Basquiat’s improvisational genius. Selling well over its high estimate for $2,964,000.

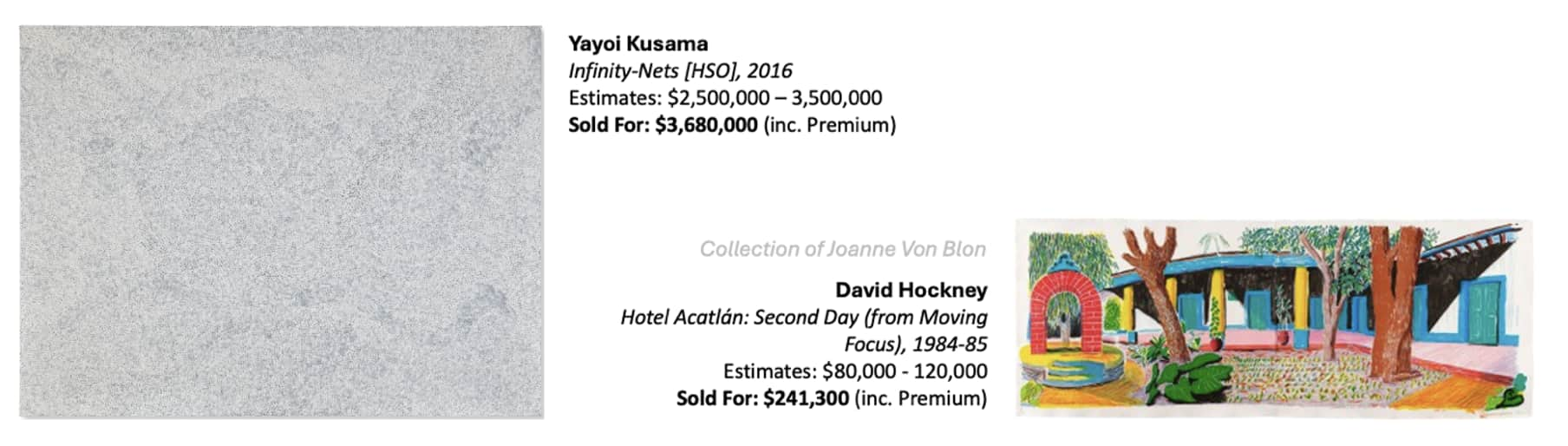

Both Yayoi Kusama and David Hockney saw strong results; A large 2016 infinity nets painting saw intrest from bidders with the work selling for $3,680,000, just reaching over its high estimate. One of her most well loved bodies of work, the painting was bought in 2016 and has been exhibited at both National Galleries of Singapore and Brisbane as well as the Queensland Gallery of Modern Art in Australia. Hotel Acatlán: Second Day from David Hockney’s celebrated Moving Focus series, coming from the Collection of Joanne Von Blon, a close friend of Joan Mitchell, saw strong interest with bidders pushing the price well above its estimates to $241,300.

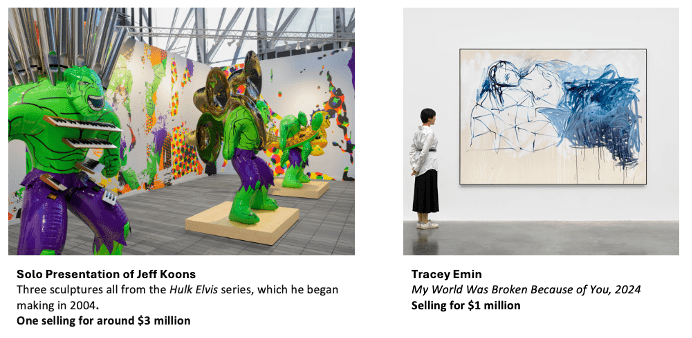

On the first day of Frieze New York sales, Jeff Koons’ Hulk Elvis sculptures sold for $3 million, while a new Tracey Emin canvas sold for $1 million. Galleries brought out their best and buyers responded. TEFAF, focused more on historic masters, saw similar energy with institutions and seasoned collectors making strategic acquisitions.

Museums, in particular, have been active buyers—using this quieter market moment to snap up works with donor backing. That institutional demand sends a strong signal to private buyers: the long-term cultural and financial value of art is intact.

This surge of top-tier supply is already restoring market confidence. Collectors are eagerly pursuing these lots, aware that such opportunities are rare. Major artists such as Pablo Picasso, Mark Rothko, Yayoi Kusama, Jean-Michel Basquiat, Jeff Koons, and George Condo are reappearing at auction and in galleries, demonstrating that the appropriate material attracts the right buyers, even in a cautious climate, further stabilising and energising the global art industry.

5. Seize the Opportunity Now

Despite the noise, the fundamentals of the art market remain strong—and are improving. Supply has returned, demand is growing, and economic conditions are favourable. Prices remain steady and have yet to rise with renewed activity, offering astute collectors a window of opportunity before the next upswing.

Art has always held emotional and cultural significance. Today, it also stands out as a rare asset class combining personal and financial value. The art market in 2025 is evolving, not declining—and those who understand this are best positioned to benefit.

If you’re looking to enter or expand your presence in the art market, now is the time to act strategically. Maddox Gallery provides expert guidance to help you source, acquire, and manage high-value art assets aligned with your investment objectives.

Let us help you navigate the opportunity. For expert guidance and personalised assistance, contact Maddox Gallery today. Invest confidently in art, invest wisely with Maddox.

The value of investments can go down as well as up, and past performance is not guarantee of future performance. Return figures shown are gross; fees, including a 20% performance commission, may apply. Liquidity is not guaranteed. Terms, limitations, and withdrawal conditions apply. Minimum recommended investment is £20,000. Maddox Advisory is not FCA-regulated and does not give financial advice. Seek independent advice before investing.