What is the halo effect in art?

The halo effect is a powerful psychological phenomenon that shapes perceptions and influences decisions in various industries, including the art world. In essence, it occurs when the success or prestige of an individual, product, or brand creates a positive bias that elevates associated attributes or products. The halo effect in art can dramatically affect an artist’s reputation, the value of their work, and the overall art market. This article explores how the halo effect manifests in art, analysing how artists’ associations with well-known collectors, celebrities, the media, or prestigious galleries significantly boost their market value.

Definition of the Halo Effect in Art

The halo effect in art refers to the way an artist's reputation is enhanced when they are linked to influential figures or institutions, thereby elevating the perceived and actual value of their work. This phenomenon plays a critical role in contemporary art investment, where perception often drives the market. Whether through celebrity endorsements, collaborations with major brands, or inclusion in prestigious collections, the halo effect can push an artist’s market value far beyond intrinsic artistic qualities.

Today’s art collectors and investors must recognize the halo effect’s impact on art market trends. Understanding how it works helps investors make more informed decisions about which artists to buy, knowing when market prices reflect the artist's true value versus when they're inflated due to external influences.

#1. The Yayoi Kusama & Louis Vuitton Halo: A Branding Success

One of the most prominent halo effect examples in art is the collaboration between Japanese artist Yayoi Kusama and luxury fashion brand Louis Vuitton. Kusama's distinct polka dot motifs became the centrepiece of a limited-edition Louis Vuitton collection in 2012, creating a global cultural moment that significantly raised her profile. This partnership is a prime example of the halo effect, showing how branding collaborations can boost an artist’s cultural relevance and market value. As a result, Kusama's artworks became valuable commodities in the global market, demonstrating how strategic collaborations can shape an artist’s career.

#2. Celebrity Endorsements & The Basquiat Halo: The Power of Influence

Jean-Michel Basquiat’s rise to art market superstardom is a perfect case of how the halo effect in art can be fueled by celebrity endorsements. Although Basquiat was a major player in the 1980s New York art scene, it was the Basquiat halo, driven by famous collectors such as Jay-Z, Beyoncé, and Leonardo DiCaprio, that truly catapulted his work into the realm of elite art. Basquiat’s artwork has become synonymous with wealth and status, further fueling demand. This halo effect example demonstrates how celebrity collectors can shape public perception and drive up art prices. For investors, paying attention to these cultural endorsements is crucial when determining how to buy art that will appreciate over time.

#3. The Banksy Halo: Press Coverage That Changed Everything

British street artist Banksy is another standout halo artist, whose work has benefited enormously from media exposure. The Banksy halo is closely tied to the media attention that surrounds his mysterious persona and provocative artworks. The Banksy boom reached new heights in 2018 when his piece Girl with Balloon shredded itself moments after being sold at Sotheby’s for £1 million. This bold act generated global press coverage, increasing the artwork's fame and value. Now renamed Love is in the Bin, it later resold for a staggering £18.5 million. This is a prime halo effect example of how media and press can dramatically alter the perception—and value—of an artist’s work.

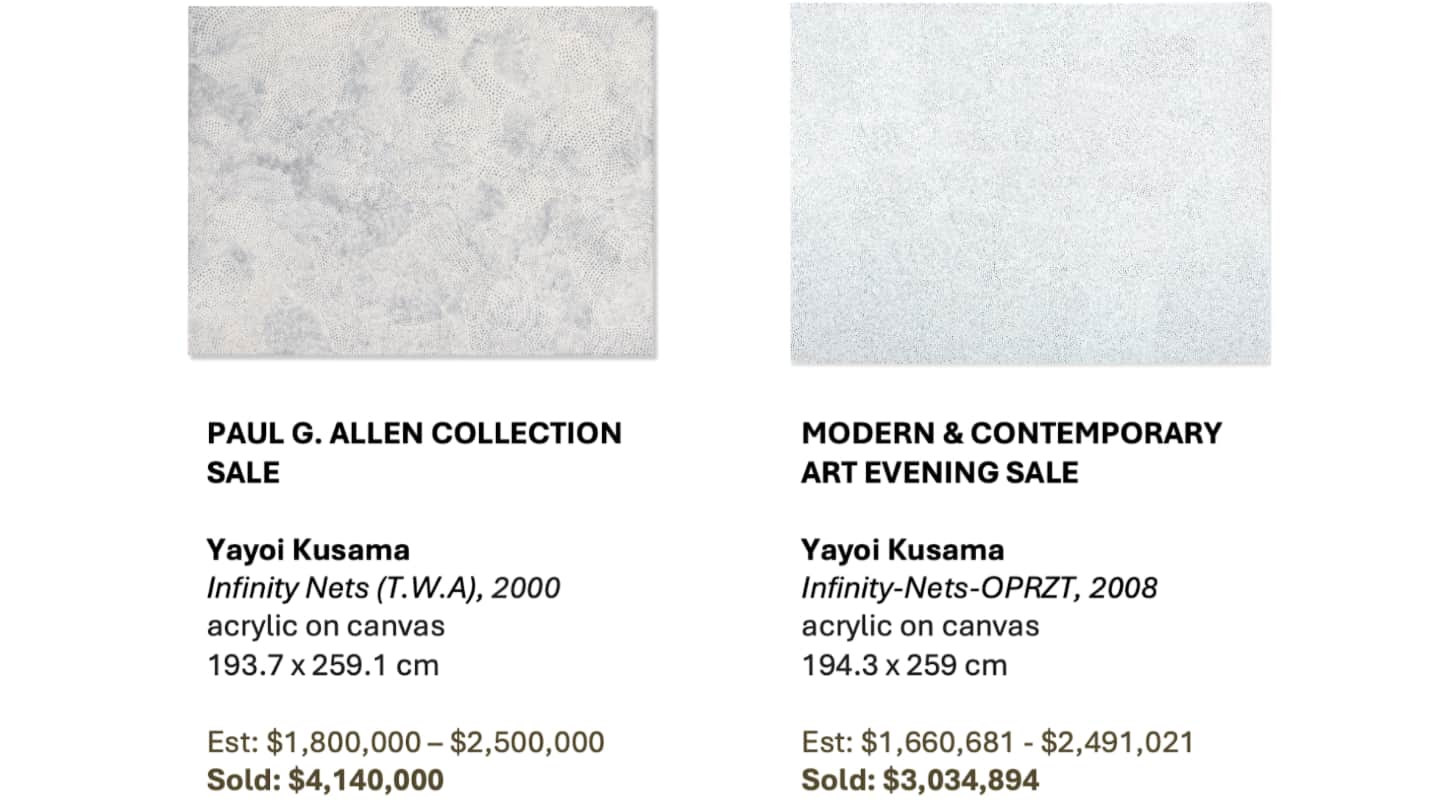

#4. The Impact of Corporate Patronage: Paul G. Allen Collection

The influence of corporate patronage cannot be underestimated when discussing the halo effect art phenomenon. One of the most notable examples is the art collection of Paul G. Allen, co-founder of Microsoft. His discerning acquisitions, which included works by Monet, Picasso, and Hockney, brought immense attention to the artists in his collection. When Allen's collection was auctioned in 2022, it brought in a record-breaking $1.5 billion, demonstrating how association with high-profile collectors can significantly boost the value of artworks. For those interested in contemporary art investment, understanding the role of corporate patrons in shaping art market trends is essential.

#5. The Keith Haring Halo: An Exhibition 20 Years After His Death

Keith Haring, a contemporary of Basquiat, has also experienced a revival in market value, years after his death, thanks to the halo effect in art. Haring’s posthumous exhibitions, such as the Tate Liverpool retrospective in 2019, have introduced his art to new audiences and collectors, renewing interest in his work. The ongoing relevance of Haring’s art, often exhibited alongside other iconic figures like Banksy, reinforces his position in the art world. The combination of the Keith Haring and Banksy dynamic in exhibitions adds to the cultural narrative, making Haring's work more attractive to investors. This resurgence shows how the halo effect can continue to influence an artist’s reputation and market value long after their death.

The final exhibition space; Photography by Theo Christelis

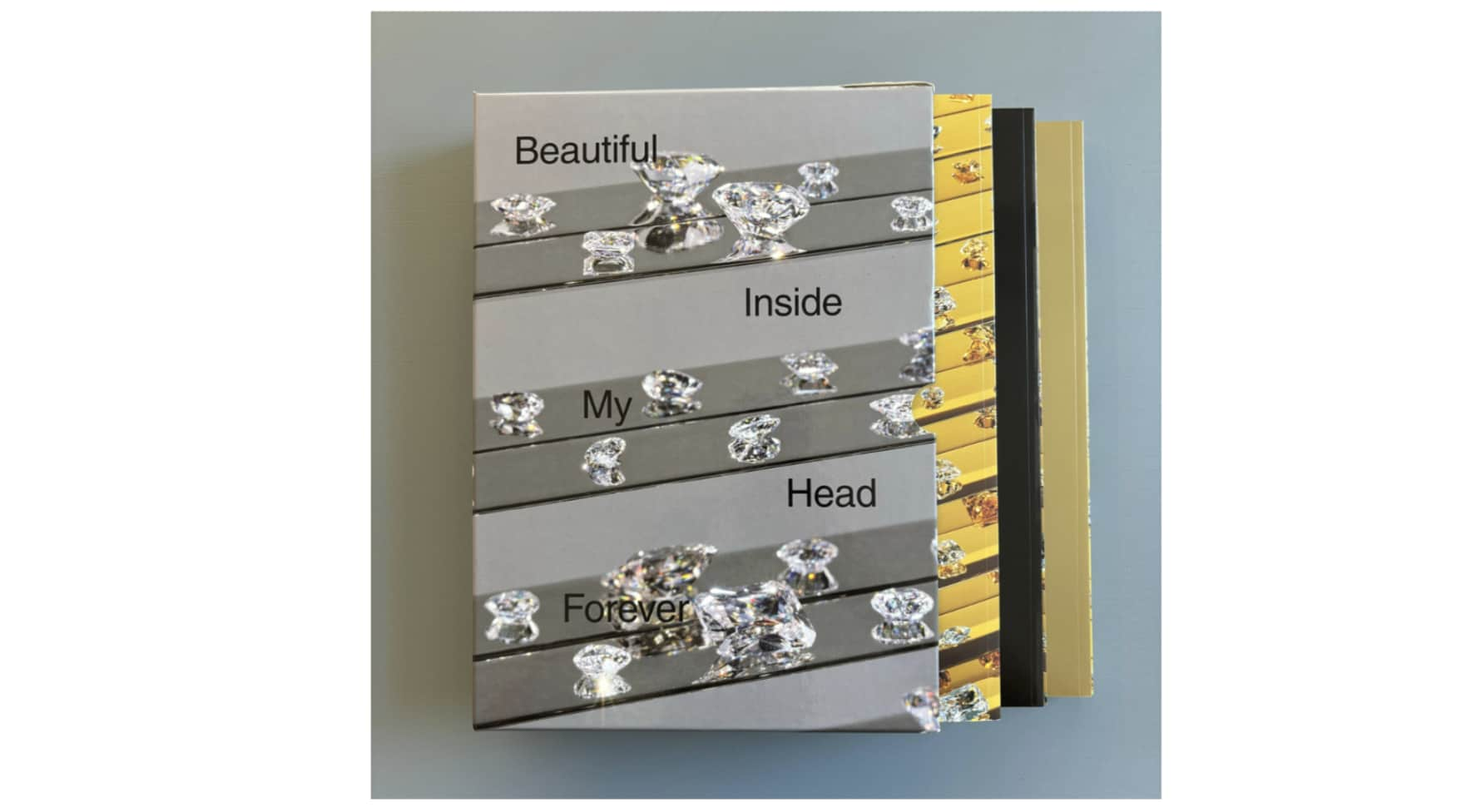

#6. The Damien Hirst Halo: Auction Catalogues as Game-Changers

Another significant halo effect example comes from British artist Damien Hirst, whose groundbreaking 2008 auction, Beautiful Inside My Head Forever, transformed the way artists manage their market value. Hirst bypassed galleries and sold directly at Sotheby’s, fetching over $200 million for his works. This strategic move not only solidified Hirst’s place as one of the most successful contemporary artists but also demonstrated the power of the auction market in creating a halo effect around his work. The Damien Hirst halo illustrates how artists can leverage auctions to increase their prestige and, in turn, drive up prices. For those interested in how to buy art that will appreciate, following an artist’s auction history can provide valuable insights.

#7. The Power of Being in High-Profile Collections

An artist’s inclusion in prominent collections can have a significant impact on their market value. Being part of the collections of influential figures such as François Pinault or the Rubell family bestows a level of prestige that can drive up prices and attract new buyers.

For example, when an emerging artist like Amoako Boafo was acquired by leading collectors, his market value skyrocketed. The halo effect of being in high-profile collections generates credibility and desirability, often setting the stage for an artist’s long-term success.

#8. The Role of Art Galleries and Institutions

Prestigious galleries and institutions also play a crucial role in shaping the halo effect. Museums, biennales, and major art fairs reinforce the halo effect by validating an artist’s work on a public, institutional level. This institutional backing further drives up demand and prices, solidifying the artist’s reputation within the global art market.

The Halo Effect on Art Prices and Value

The halo effect can significantly boost the prices of artworks, especially when lesser-known artists are linked to top-tier collectors, prestigious galleries, or auction houses. Associations with influential figures like Paul G. Allen or sales at Sotheby’s can inflate an artist’s perceived value, driving up demand and prices. This effect isn’t limited to established names like Banksy or Hirst; emerging contemporary artists can experience similar price surges through these powerful connections.

Psychologically, the halo effect in art leads investors to prioritise reputation over the intrinsic quality of the artwork. As seen with the Banksy boom, media hype and celebrity endorsements can fuel soaring valuations. While this effect can yield significant short-term gains, it also poses risks. If the associations fade, prices can drop just as rapidly.

However, relying on the halo effect for contemporary art investment comes with risks. Every investor should know what the halo effect is, as they may find themselves buying into hype rather than the intrinsic value of the artwork. It’s essential to assess whether an artist’s market value reflects genuine artistic merit or is inflated due to external associations. While the halo effect can drive quick appreciation, it’s crucial to evaluate an artwork’s long-term potential to avoid overpaying based on hype.

Conclusion

The halo effect plays a powerful role in shaping the art market, influencing prices, reputation, and investment trends. For collectors and investors, understanding this phenomenon is critical to making informed decisions. The association with high-profile collectors, prestigious galleries, and media exposure can create lucrative opportunities, but they also present risks if hype overshadows true artistic value.

For those interested in navigating this complex terrain, Maddox Gallery’s art advisory can help identify artists who are experiencing the halo effect and advise on how to invest wisely in contemporary art.