As US-China tariff tensions intensify, luxury brands are being exposed on social media, revealing a troubling reality of mass production behind high price tags. Unlike these vulnerable luxury goods, art investment remains untouched by tariffs, providing a timeless sanctuary of value and authenticity.

Amid the ongoing US–China tariff dispute, luxury brands are facing scrutiny as Chinese factories take to TikTok, fuelling a copyright debate. In widely shared videos, factory workers and business owners claim that around 80% of high-end luxury brands—such as Gucci, Prada and Louis Vuitton—are manufactured in China before being sold internationally at steep mark-ups. A 2023 report estimates there are 200 to 250 fashion and accessory brands classified as “luxury” worldwide, with 70 to 100 recognised as top-tier global labels.

In contrast to mass-produced luxury and the volatility of global trade, art investment remains a sanctuary. As tariffs and unclear import duties increase, art—whether a one-of-a-kind painting or a limited-edition print—offers both a stable investment and a source of authenticity and emotional value.

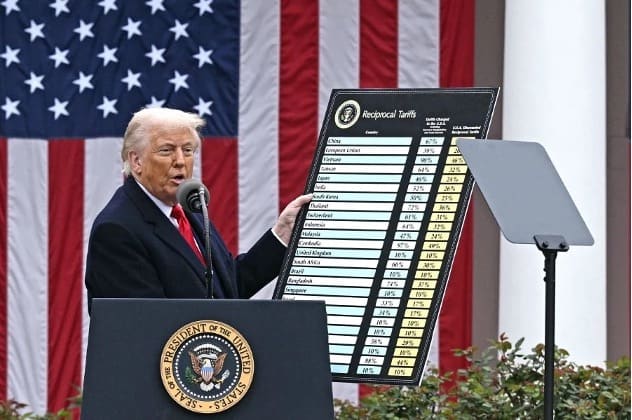

US President Donald Trump showing Reciprocal Tariffs © BBC News

The Hollowing Out of Brand Identity

In an era of increased outsourcing, many luxury brands have gradually lost the very essence of what once made them remarkable. Outsourced production has hollowed out these brands so that, often, all that remains is a symbol, a logo that now represents only a price tag and an elusive tax bracket. Similar to the way that synthetic diamonds have disrupted the diamond investment market significantly, reducing their investment appeal, luxury goods are facing a comparable devaluation of intrinsic worth. While luxury goods such as handbags, watches, and jewellery have recently seen a rise in auction presence, especially among younger collectors, many of these goods are still manufactured in Chinese factories despite using legal loopholes to disguise this fact.

Recent tariffs as high as 105% have triggered a reaction among Chinese manufacturers, prompting them to bypass established brands and produce identical, unbranded merchandise using the same materials in the same factory, selling directly to the consumer. As a result, the only distinction between the branded “luxury” goods and its unbranded twin becomes the pricing, as their heritage of artful craftsmanship and unique brand identity have been stripped away, rendering many traditional luxury brands redundant.

Maddox Berkeley Street Gallery with Banksy Flower Thrower and Basquiat's Portfolio of four screenprints

Art: The Timeless Investment

Art stands in stark contrast to the ephemeral trends of mass-produced luxury. It is a medium that captures and preserves cultural narratives, identity, and emotion, qualities that endure far beyond the lifespan of disposable, seasonal trends. While today’s luxury products may quickly fade from relevance, art endures across generations, remaining a beacon of human creativity and historical continuity. Few can recall the specific products luxury brands offered a decade ago, yet the 500-year-old Mona Lisa continues to attract 7 to 10 million visitors annually. Similarly, Yayoi Kusama’s immersive installations, called Infinity RoomsYayoi Kusama’s immersive Infinity Room at Tate Modern drew 713,000 visitors in 2012, and her recent retrospective at the National Gallery of Victoria became the best-attended ticketed art exhibition in Australian history, welcoming over half a million visitors in just four months. These enduring attractions underscore art’s unparalleled appeal, a timeless investment that not only transcends fleeting consumer fads but also offers a lasting cultural legacy.

Tariff Wars, Trade Uncertainty, and Art as a Strategic Refuge

When global trade is rocked by tariff disputes and unpredictable market shifts, art emerges as a robust refuge. As tariffs continue to unsettle both traditional and luxury markets, the art market offers an unparalleled shield against fiscal volatility. Historically, art investment has proven its resilience during times of economic instability time and time again, flourishing as investors pivot away from faltering markets, flourishing as investors pivot away from faltering markets. Beyond its aesthetic appeal, art encapsulates cultural identity, historical narratives, and personal storytelling, all factors that cement its long-term value. When luxury goods lose their lustre to mass production and imitation, genuine art stands as a testament to human creativity and enduring authenticity.

Investing in art today not only helps to safeguard your financial future but also champions a culture of ethical craftsmanship and meaningful expression. As the tides of modern commerce continue to shift unpredictably, art remains the lasting bulwark when investing during tariffs, an asset of both sentiment and fiscal strength that no manufactured duplicate or tariff can diminish.

At Maddox Gallery, we understand the enduring value of true creativity and heritage. Discover how art investment can fortify your portfolio against economic unpredictability and tariff turbulence, by contacting one of our Maddox Art Advisory experts to begin your journey into lasting value and genuine craftsmanship.

The value of investments can go down as well as up, and past performance is not guarantee of future performance. Return figures shown are gross; fees, including a 20% performance commission, may apply. Liquidity is not guaranteed. Terms, limitations, and withdrawal conditions apply. Minimum recommended investment is £20,000. Maddox Advisory is not FCA-regulated and does not give financial advice. Seek independent advice before investing.