Investing in art offers a unique blend of emotional fulfilment and financial rewards. From the joy of owning cultural masterpieces to the potential for long-term value appreciation, discover the top 4 advantages of art as a passion investment and why it remains one of the most rewarding ways to enhance both your lifestyle and your portfolio..

Understanding Passion Investments

Some people invest to make money, others for the sheer pleasure of it. Passion assets sit somewhere between the two. Made to be enjoyed, passion investments are the only asset class that is guaranteed to bring you happiness.

Passion assets are luxury collectibles that appeal to us on an emotional level. Acquired because we love to surround ourselves with them, these investments bring great satisfaction and pleasure to their owners.

Hand painted 1970s Porsche 3.0 RSR by Lefty Out There

From a work by an exciting Contemporary artist to a vintage Porsche, a Rolex watch or a great Bordeaux wine, investments of passion are on the rise. Driven by a desire among investors to put their money where their heart is, the benefits of ownership are manifold and include asset diversification, capital appreciation and the simple joy of ownership.

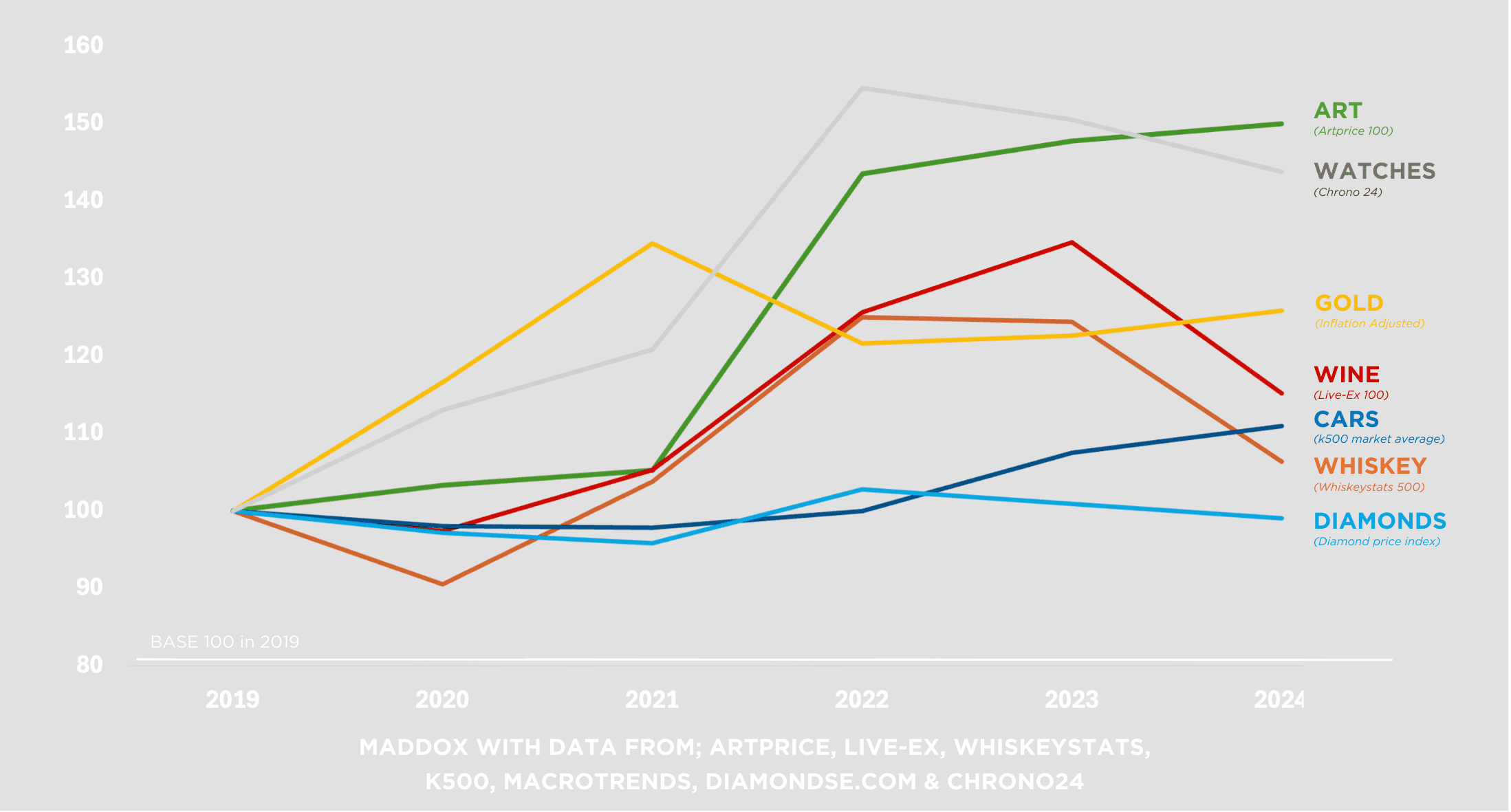

Out-shining all other luxury collectibles, art consistently comes out on top as the best-performing passion investment due to its cultural significance, aesthetic appeal and steady track record of long-term appreciation. With its unique combination of emotional satisfaction and financial returns, art connects collectors to cultural and historical narratives, while also serving as a valuable asset.

Some are driven to acquire passion assets purely based on passion, while for others it is a mix of head and heart. Whatever your motivations, a passion investment has the potential to offer the best of all worlds: enormous aesthetic pleasure, significant cultural value and great returns over time.

The Key Benefits and Pleasures of Art as a Passion Investment

1. Passion Assets Bring Emotional Satisfaction and Fulfilment

Part of the attraction of art as an investment is that it has a tangible and subjective value. Beauty really is in the eye of the beholder. Much more rewarding than traditional investments, passion investments allow collectors to derive deep personal satisfaction from their assets.

Proven to enrich your quality of life, passion assets improve your sense of well-being through the aesthetic pleasure of owning them. With art in particular, collectors enjoy distinct benefits from their investments. Offering a lifetime of enjoyment while enriching your living spaces and identity, art encourages deep emotional connections—with an artist, an era and yourself—as you seek out works that resonate with you on a personal level. Providing daily visual, intellectual and cultural stimulation, ownership gives you a unique insight into a human experience that can only be accessed through the power of art.

2. Buying Fine Art as an Investment Offers Long-Term Value Appreciation and Stability

In times of economic instability and high inflation, traditional assets are perceived as increasingly risky, making fine art a valuable addition to long-term investment strategies. Whether it’s an original Warhol, a classic Aston Martin or a pristine Patek Philippe timepiece, the fact that a passion investment is real and tangible is incredibly reassuring.

The classification of art as an asset class can be traced back to the late 1960s, with the art market experiencing consistent growth ever since. Blue chip art investment, in particular, has shown remarkable resilience, providing consistent financial returns, even during market downturns.

Historically, works by established artists such as Andy Warhol and Damien Hirst are expected to steadily increase in value, or at least hold their value over a period of time. Works by emerging artists, meanwhile, can increase in value far more dramatically if their profile rises significantly in the future, although this trend is not as reliable. Collectors can therefore choose their level of risk and reward, opting for potential high growth with emerging artists or slower, more consistent growth with established names.

3. Passion Investing Offers Portfolio Diversification

The COVID-19 pandemic and recent geopolitical tensions have reinforced the importance of asset diversification when it comes to fortifying an investment portfolio over the long term. Passion investments serve as excellent portfolio diversifier, reducing risk by creating a balance with more volatile asset classes.

Many investors view art as a safe haven for their capital, primarily because the price of art is not directly tied to major economic markets. Retaining its value, even when stocks and bonds are fluctuating, this lack of correlation offers diversification benefits because it reduces an investor’s risk levels while enhancing the overall resilience of an investment portfolio.

Historically, the art investment market has remained relatively stable through economic, social and political upheavals that have seen asset classes such as gas and oil spiral in cost, with art consistently outperforming the stock market during financial downturns. A refuge during periods of high inflation, when the purchasing power of currency deteriorates, fine art consistently retains its value.

And then, of course, there is the fact that buying fine art as an investment is undoubtedly the most satisfying form of portfolio diversification. As stable stores of wealth that symbolise our passions and interests, there is no other passion asset that can help hedge against inflation and economic instability while bringing enormous fulfilment and satisfaction.

4. There is Cultural and Intellectual Value in Investments of Passion

It is no coincidence that for the majority of collectors, art becomes a lifelong passion. Collecting art as an investment offers so much more than financial rewards—it creates a connection between the past and the present, and enriches the collector’s understanding of history, society and artistic evolution. By owning a work by Yayoi Kusama, for example, the collector becomes a custodian of an important cultural asset. The act of preserving art carries real historical significance, particularly as artists age and their output dwindles.

Alicia Keys and Swizz Beatz in their living room

Collectors also become stewards of cultural heritage, preserving works that reflect important social, historical and creative narratives. All artwork comes with a story, an inspiration and a history. From Keith Haring’s ability to spread light in the dark times of 1980s New York to the politically charged social commentary of street artist Banksy, every artwork portrays an emotion, a message or a moment.

Just as Andy Warhol came to define the 1980s New York art scene, artists like KAWS, The Connor Brothers and Takashi Murakami are busy interpreting the world as it is today for future generations to critique. This intellectual connection greatly enhances the personal and societal significance of fine art passion investments.

Risk Factors to Consider when Collecting Art as an Investment

While passion investing in art can be financially rewarding, it requires knowledge of the market and a long-term approach to ensure success. The value of art is subjective and dependent on market trends. This means that expert guidance is essential, particularly for new investors.

Unlike currency, stocks and bonds, which can be sold with little to no wait time, art is an illiquid asset. The notion of liquidity reflects the ease with which an asset can be traded, and art’s lack of it can prove challenging. While it may be valuable, it isn’t always easy to sell art quickly. Factors such as the supply and demand for works by a particular artist, the rarity of the work in question and the overall dynamic of an artist's marketplace can all affect how long it takes to sell an artwork, and at what price.

When considering potential fine art investment returns, it pays to be aware of market trends. There are three main reasons why art rises in value: an increase in the perceived worth of an artwork in the marketplace; a change in the status of the artist; and inflation. Savvy investors will look for opportunities to leverage changes in the perception of the value of an artwork or their reputation as an artist to their advantage, selling when the market is at its peak.

Conclusion: Why Art is the Top Passion Investment

Now that you are familiar with what passion assets are, let’s recap on the benefits of investing in art. From a financial perspective, art has historically been a reliable asset class promising consistent economic returns over time, making it a wise choice for those looking to combine passion with profit. Offering a compelling alternative to traditional assets, art is increasingly being sought out to bring diversity to investment portfolios and as a means of resisting inflationary pressures.

A physical representation of your beliefs and passions, an artwork can hold great cultural and intellectual value, as well as being a legacy to pass down to younger generations. One of the few investments where the emotional rewards can be just as fulfilling as the financial benefits, acquiring an artwork that you are inexplicably drawn to offers immense emotional satisfaction. The most inspiring of all the asset classes, the enjoyment of ownership cannot be overstated, and that feeling is priceless.

If you are considering making the move into art investment, we’re here to help. Contact Maddox Art Advisory today to help chart your path to passion investment in art.

The value of investments can go down as well as up. Past performance is not a guarantee of future performance. Fees, Terms and Conditions apply. Please seek your own financial advice before purchasing.